The renewable markets are way way bigger than any of us expected… even those of us that are witnessing the growth first-hand. At Energize we are starting to see accelerating growth rates across the portfolio at revenue levels that usually succumb to scale. One of those success stories is Aurora Solar, and they have a big announcement today.

You can read their Forbes coverage here: Solar Design Startup Aurora Solar Reaches Unicorn Status or the Techcrunch coverage here: Aurora Solar Aims to Power the Solar Industry with a $250M Series C

Energize’s blog post is found here and the company’s press release is below.

Funding Round Led by Coatue Signals Market Interest in the Growing Solar Industry

SAN FRANCISCO, May 24, 2021– Aurora Solar, the industry’s leading software platform for solar sales and design, today announced it has closed a $250 million Series C funding round led by Coatue, with follow-on participation from existing investors ICONIQ, Energize Ventures, and Fifth Wall.

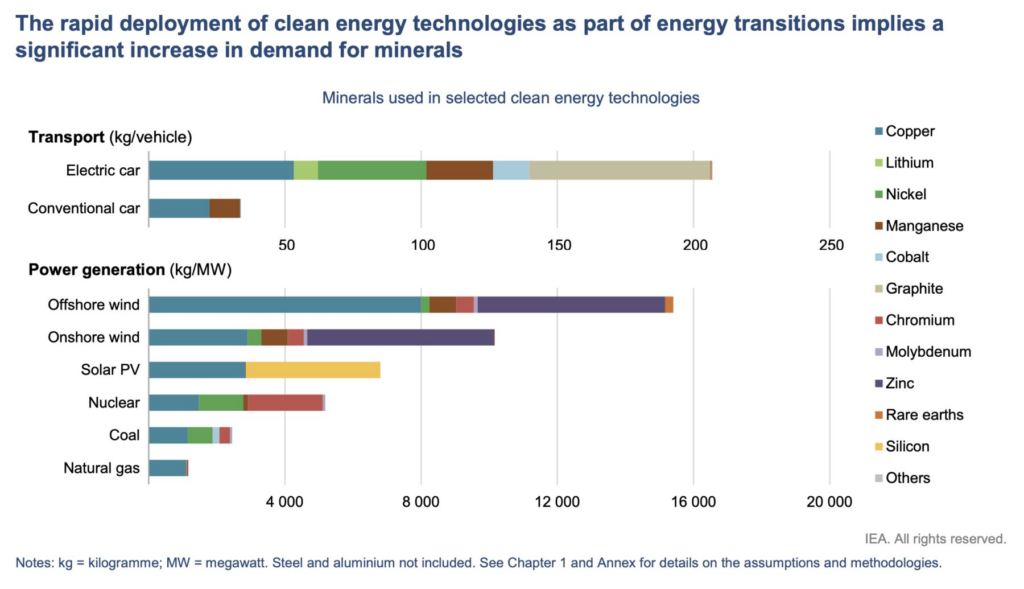

In just over two years, Aurora Solar has raised more than $320M. Today’s fundraise underscores the remarkable shift to renewable energy happening in energy markets around the globe, with solar being the fastest-growing source of energy over the past decade. This growth translates into jobs —by 2030, in the United States alone, the solar industry will need to grow from 230,000 to 900,000 people in order to meet President Biden’s goal of carbon-free power by 2035, according to the Solar Energy Industries Association. Software is the key to making solar installations affordable and accessible for both residential and commercial use cases.

Aurora enables solar companies to streamline the solar project lifecycle by making it easy to integrate disparate data sources, design accurate solar installations, and automate complex workflows. Using Aurora, solar professionals can accurately determine how many solar panels will fit on a property, forecast how much energy the solar system will produce, calculate how many batteries are needed for backup power, and show how much money their client will save by switching to solar.

“Our mission is to create a future of solar energy for all. The only way to reach that goal is to make it easy for solar professionals to design and sell solar remotely, and to make it affordable for consumers to understand and access the benefits of solar” said Sam Adeyemo, Aurora’s co-founder and CRO. “This funding will help us accelerate our vision, as more solar companies choose to grow their business using digital and remote solutions rather than manual ones.”

Since 2010, the install costs for photovoltaic solar have already dropped by 70%, and reducing soft costs (i.e., non-hardware costs associated with going solar) through digital solutions like Aurora offers the biggest opportunity to continue cutting down the price of both residential and commercial projects.

“Residential solar is set to grow significantly over the next decade,” said Jaimin Rangwalla, Senior Managing Director at Coatue. “Aurora has the potential to unlock an inflection in this growth through lowering soft costs, such as installation and permitting. We believe Chris and Sam have proven themselves to be exceptional operators and have built the leading software business in this category. We are excited to partner with them on the next phase of this journey.”

“We see an incredible opportunity to expand the market for solar software and make it accessible to anyone on the team, from sales and marketing to design and operations and more,” added Chris Hopper, co-founder and CEO of Aurora Solar. “Working firsthand with solar professionals in communities around the globe has given us a front row seat to the explosion in the solar market and the economic opportunities it is creating for more jobs, lower costs, and a greener future for us all.”

Aurora Solar will use the investment to expand its product roadmap, continue to attract more talent across all teams, expand sales and customer support, and build its leadership team to help scale the company.

To learn more about Aurora Solar:

- Register for Empower Solar, our free, virtual event on June 8th and 9th where we bring the solar industry together to share knowledge, expertise and insights. We will also be unveiling some of our biggest products to date here!

- Visit our career page to learn more about opportunities with our team.

About Aurora Solar Inc.

Aurora Solar is a fast growing technology company that enables solar professionals to remotely design and sell solar and storage projects. Aurora Solar was named Rising Star Company by S&P Global Platts in 2020. To date, over 5 million solar projects have been designed in Aurora globally. For more information, visit www.aurorasolar.com and follow us on Twitter @AuroraSolarInc.