I’ve gained a lot of value from posting to this blog over the years. But the story below probably is my favorite example of creativity, content, and the long-term relationship mindset we have at our firm.

On August 30, 2022 I wrote a post here about how a portfolio company was looking to hire a GM for their energy business. An ambitious software entrepreneur with experience in data analytics that was intrigued by the energy landscape cold emailed me in response to my post and came by Energize’s Chicago HQ a few days later. While that specific GM role was not the right fit for him, the visit led to a multi-year engagement with the entrepreneur whereby the Energize team was able to ideate on energy software opportunities and subsequently monitor a stream of innovation and execution.

That entrepreneur was Max Kanter and today Energize is announcing the first institutional investment, an $8M round, into Max’s new company, GridStatus.io. Max is one of those rare entrepreneurs where I have been able to witness the raw combination of talent, curiosity, and execution. Through that combination GridStatus has immediately gained coverage across most major publications (WSJ, NY Times) and quickly become the data team for the energy transition. The Energize blog post “Why We Invested” can be found here and an article about the company & raise on Canary Media. The press release is posted below:

Grid Status Raises $8M to Democratize Access to Real-Time Grid Data to Meet Demands of Rapidly Changing Energy Grid

– Round led by climate investment firm Energize Capital underscores critical need for real-time, accessible data and analytics to accelerate the energy transition

– Company launches first and only publicly available national real-time wholesale electricity price map; will use funding to scale its rapidly growing teams across engineering, sales and marketing

CHICAGO, August 21, 2024 — Grid Status, the modern data and analytics platform for the electric grid, today announced an $8M funding round led by Energize Capital. Investors joining the round include Nat Friedman and Daniel Gross (NFDG Ventures), Rayburn Electric Cooperative, Evergreen Climate Innovations and other individual investors. This first round of outside funding will enable Grid Status to scale its team and product to meet the data demands of the rapidly changing energy industry.

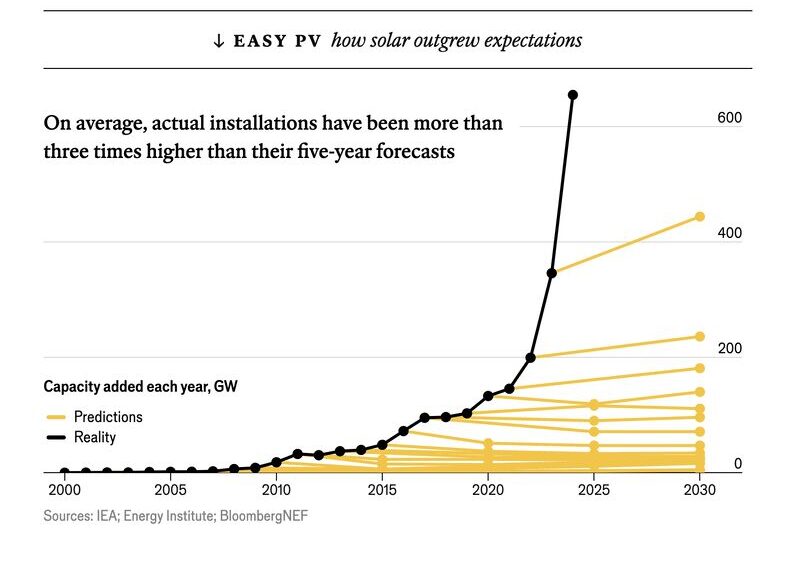

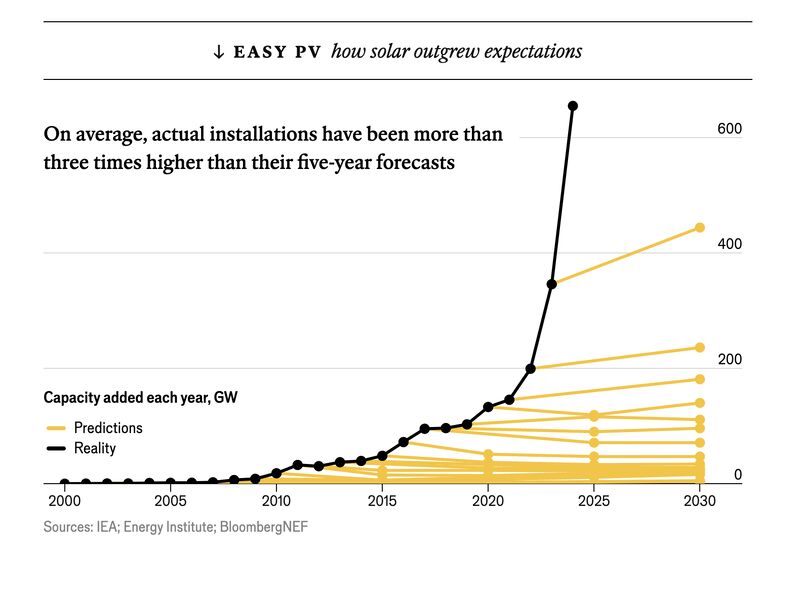

The electric grid is undergoing a major transition as increasing volumes of renewable energy technologies come online and energy demand spikes in key regions. Combined with more challenging operating conditions due to extreme weather events and volatility in wholesale energy markets, the energy industry is in need of a reliable, real-time data platform. Grid Status democratizes access to grid data by offering easy-to-digest insights on current and historical grid activity, including fuel mix, load, locational marginal prices, renewable adoption, and more. With Grid Status, energy professionals can make informed decisions for their business, and everyone can track key energy benchmarks more efficiently.

“Renewable energy, AI-fueled load growth, electrification, and intensifying weather events are some of the trends making accessible data about the grid more important than ever,” said Max Kanter, CEO of Grid Status. “Our mission is to provide everyone working on a clean and reliable grid convenient access to data they can trust.”

Since its founding in 2023, Grid Status has rapidly grown to over 10,000 active users across the energy industry who use its data products to understand what’s happening on the electrical grid and in wholesale energy markets.

“Our energy grid is growing increasingly unstable and complex, and at the same time the volume of data coming from devices with embedded computing has skyrocketed,” said Tyler Lancaster, partner at Energize Capital and a member of the Grid Status board of directors. “As the grid continues to evolve, we’re seeing an increasing number of parties who are interested in grid data – from electric utilities and renewable energy operators to research and cloud computing firms. The convergence of these conditions highlights the need for a modern solution for managing and interpreting data. Grid Status’ open-source, reliable and easy-to-use platform is the data tool for all participants in the next generation of the energy industry.”

The Grid Status platform collects, standardizes, and analyzes hundreds of energy datasets, enabling users to create dashboards, leverage analytics tools through Grid Status Pro, and gain robust data access via APIs and integration with enterprise data warehouses like Snowflake. Furthering its mission to make critical grid data easily and widely accessible, the company also announced the release of the industry’s first and only publicly available real-time wholesale price map. This map, along with new platform functionalities, will help users understand what’s happening on the grid at a glance. Users can access this map as a standalone app or within various dashboards across the site.

Grid Status currently has customers across the energy sector, and its users span a majority of renewables developers, energy consulting firms, and ISOs and RTOs in the U.S. It also supports utility operations, demand response aggregators, battery dispatch optimization, trading desks, and innovative startups.

“Using Grid Status enhances our operational efficiency, enabling us to provide more reliable and responsive energy solutions for our members,” said David A. Naylor, President and CEO of Rayburn Electric Cooperative, a customer of Grid Status. “This innovative platform helps us gain deeper data insights, facilitate seamless data sharing and communication, and improve our ability to analyze and monitor critical information. In addition to being a customer, our investment in Grid Status underscores our commitment to utilizing advanced technology to meet the evolving needs of our members and the broader north Texas community.”

To learn more about Grid Status, view open positions, and sign up for the Grid Status Pro beta program, please visit gridstatus.io/.

About Grid Status

Grid Status is an energy data and analytics company based in Chicago, Il. Founded in 2023, Grid Status provides an open platform to understand what’s happening on the electrical grid. With organized and reliable data, Grid Status empowers the next generation of energy innovators to focus on building new solutions without having to maintain their own complex data pipelines.

About Energize

Energize Capital is a leading investor in climate solutions. Founded in 2016 and based in Chicago, Energize seeks to scale sustainable innovation by partnering with the builders and operators shaping the future. To date, Energize has funded 28 companies and deployed more than $500 million through its venture capital and growth equity strategies. Anchored by founding partner Invenergy, the firm is backed by strategic, institutional, and impact LPs including CDPQ, Credit Suisse, GE Vernova, Xcel Energy, Caterpillar, HASI and more. For more information on Energize, please visit www.energizecap.com.