Matt Ridley is the author of a number of award-winning books. Notable hits include The Evolution of Everything and How Ideas Emerge. My personal favorite of his is The Rational Optimist. One of the many reasons I enjoy Matt’s writing is his ability to deconstruct complex outcomes to their foundational drivers.

I am working on a longer-form paper that details some of the emergent behaviors of technology in the energy and industrial transition. In the research process I have engaged a number of complexity and platform leaders. One of those leaders, the esteemed VC Bill Gurley of Benchmark, pointed me to Matt Ridley’s latest book, How Innovation Works and referenced that there is actually a section on energy innovation. Well, one week later and I have covered the book and am happy to give it a ringing endorsement. Whether you are new to energy or an experienced pro, you will learn something new. And, classic to Matt Ridley, he frames energy innovation in a refreshing way.

My Favorite Themes, Quotes & Takeaway from the Energy Section

Theme 1: Failure is the father of Innovation

Innovation is itself a product, the manufacturing of which is a team effort requiring trial and error.

Edison called his work “the invention business”. “He remained relentlessly focused on finding out what the world needed and then inventing ways of meeting the needs…his method of invention was always trial and error. In developing the nickel-iron battery his employees undertook 50,000 experiments. (!!)

“Inventing is 1% inspiration and 99% perspiration”

Theme 2: Innovation is Inevitable

I am fascinated by how technology inventions seem to converge at a specific point in time. And particularly how this convergence occurs after extreme technology advancement and trial/error reminds me a lot of Michael Waldrip’s Complexity. The technologies that enable a transformation are all advancing independently AND interacting with each other. Add in a number of entrepreneurs, acting as catalysts, and suddenly new structures emerge at the “edge of chaos” that result in a new, higher order of efficiency. This arrival to a ‘higher order’ occurred with the lightbulb, and looks a lot like what is happening today with the interacting forces driving a digitized and decentralized energy network.

“Simultaneous invention marks the progress of technology as if there is something ripe about the moment. It does not necessarily imply plagiarism. In this (steam engine) case, the combination of better metalworking, more interest in mining and a scientific fascination with vacuums has come together.. to make a steam engine almost inevitable.”

“The lightbulb emerged inexorably from the combined technologies of the day. It was bound to appear when it did, given the progress of other technologies.”

Theme 3: Innovation Turns Ideas into Practical, Reliable and Affordable Reality

There is a difference between invention and innovation. According to the book, innovation is how famous names like Thomas Edison rise to the top of the 21 inventors who lay claim to inventing the lightbulb. Edison was focused on innovating and specifically on reliability as he tested over 6,000 different filaments for duration and cost.

The ability to take a technology invention and gradually (through testing) get to a customer-available product is where innovators stand out.

Theme 4: Innovation in Energy is Evolution, not a Series of Revolutions

“Long after the key technologies had been invented, innovation continues.”

The first turbine was 2% efficient and today a combined cycle gas turbine is 60% efficient. This 100+ year journey was a collaborative effort with no 1-time transformations. Innovation came from small steps of experts, testing along the way.

The book then also explains why certain atomized production processes improve. And then goes into great detail on how other large scale projects, hampered by the rising costs for regulation, begin to dis-innovate. This is my favorite line:

“Nuclear is ill-suited to the most critical innovation practices: learning by doing. ” The best products leverage subject matter experts to tweak and innovate along the way. The experts find a way to test, iterate and improve. This testing happened successfully with shale gas exploration and fracking: west Texas wildcatters who had small companies were able to buy mineral rights from land owners and were more nimble to do small tests. In other, more regulated oil & gas countries, this innovation could not persist as the state/country owned the land rights.

What this Means TODAY

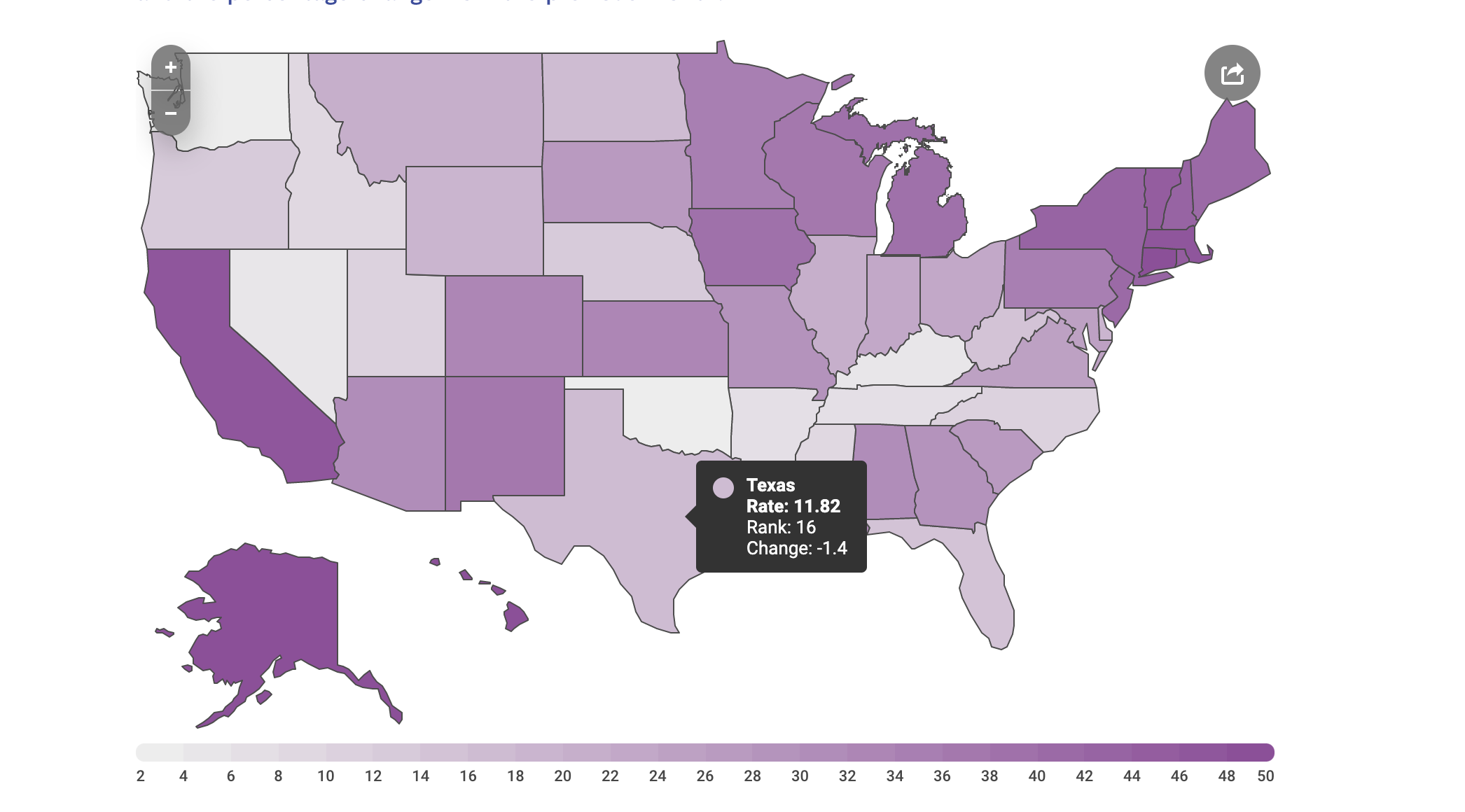

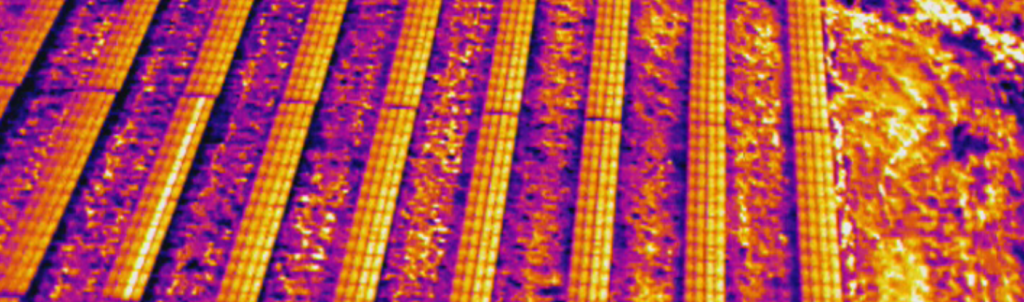

The installed bases of new energy technologies is gaining critical mass: wind, solar, batteries, EV charger. Wind and solar have gained efficiencies over the years: wind OEMs have made increasingly aerodynamic and larger blades alongside improved gearboxes and materials costs; solar is improving absorption rates and further accelerating efficiency through better inverters, trackers and 2-sided panels. In addition to the hardware, operators are getting better at O&M as they leverage remote communications network, drones, and predictive analytics. All of these continued innovations are consistent with the slow & steady march towards record-setting productions levels.

This installed renewable base coupled with advances in data products, connected devices, and software management, are apt to create a new wave of simultaneous digital advancements. These software solutions will not only accelerate the efficiency of these verticals but improve interoperability with the operating environment. As a result, we are likely to see innovative customer behaviors as these energy consumers adapt to the new product suite available. While fantastical now, these prospective new products and behaviors will seem like inevitable advances in the near-future. How fortunate are we to have the march of innovation?

Summary

In How Innovation Works, Matt covers other verticals Public Health, Transport, Food and Communications. Then he pivots to more horizontal themes such as the economics of innovation, and identifying fads and frauds. He ultimately wraps up with how to get around (the expected) resistance to innovation and which cases are worth fighting. Again, go buy the book – the perspective is clarifying and refreshing.