Volta Industries, Inc., the industry leader in commerce-centric electric vehicle (EV) charging networks, today announced that it has entered into a definitive business combination agreement with Tortoise Acquisition Corp. II (NYSE: SNPR), a publicly traded special purpose acquisition company (SPAC). When the transaction closes, the combined company is expected to be publicly traded under the symbol “VLTA”. The pro forma enterprise value of the transaction is about $1.4 billion.

Volta will use this financing to further expand their network to meet the growing demand for electric vehicle infrastructure. Founder and CEO Scott Mercer will continue to lead the company, as he has since 2010. Scott brings a rare, market-visionary approach to the energy transition. Chris Wendel, Co-Founder and President, will also continue in his lead role for the high-growth company, helping it to master the complexity of the market.

Why now is the time for the EV charging market

Electric vehicles are here. Almost every week a new country, state or vehicle manufacturer commits to an increasingly imminent electric-only future. In 2011, I test drove my first electric vehicle and saw my first business pitches for EV charging. The cars were clunky and the infrastructure untested. At the time, market investment and adoption were not meaningful to me.

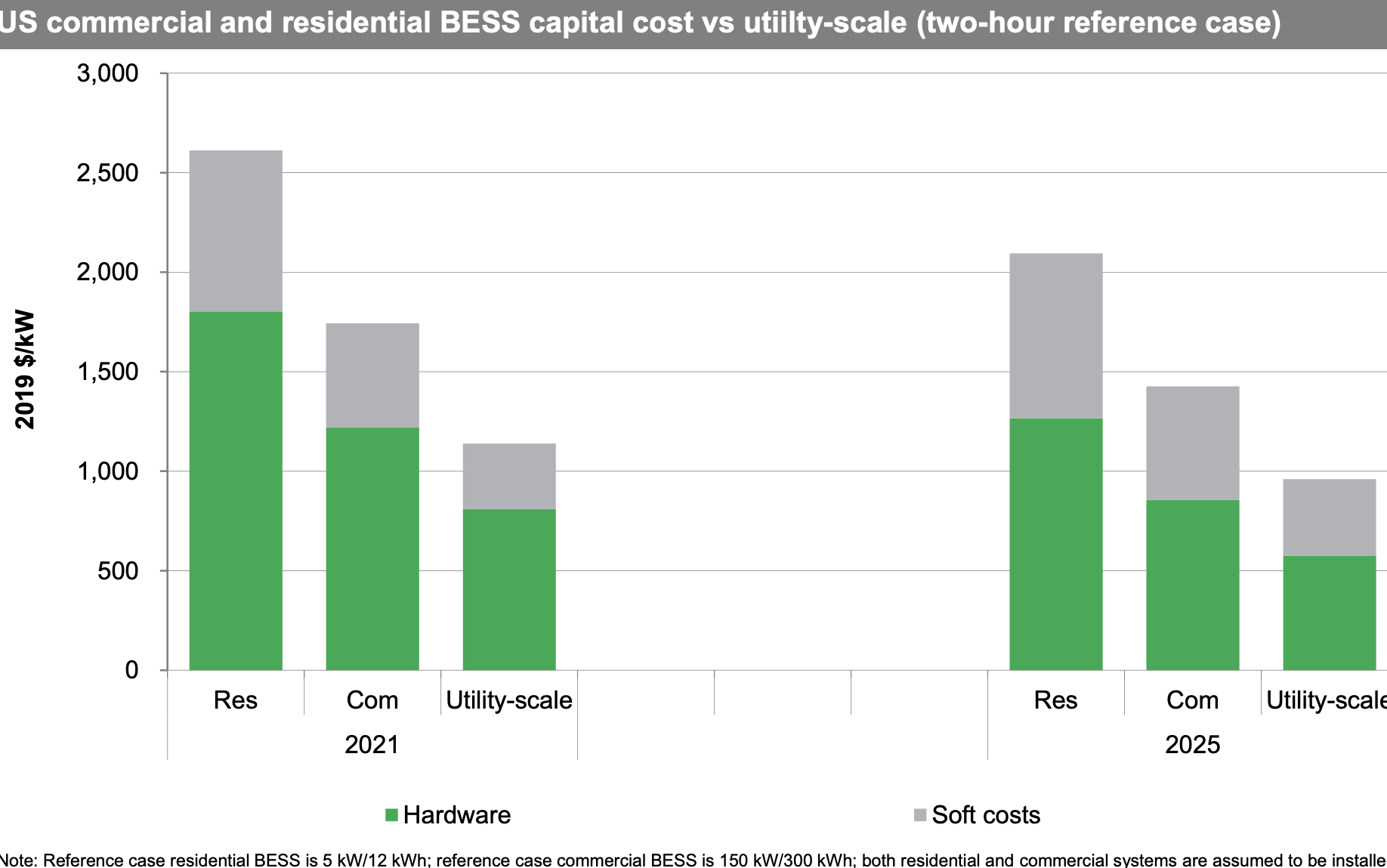

Over the last decade, investment and business model innovation in materials science, batteries, charging infrastructure, and new EV models has propelled electric vehicle adoption. I now have no doubt that mobility will be electrified, and believe Volta will play a key, complementary role in building out the infrastructure layer for the electric mobility transition.

Our relationship with Volta

Having witnessed the first EV charging pitches a decade earlier, I knew something special was happening at Volta when I first heard the pitch at a Department of Energy conference in Houston in December 2017. What stood out to our team about Volta was its commerce-driven business model: We believe this unique approach will continue to be a primary contributor to Volta’s high utilization rates, consumer happiness and long-term relationships with site partners.

Since Energize joined Volta’s capitalization table three years ago, we have invested across four different financing rounds and deployed nearly $35 million into the company. Energize first invested in Volta by leading the Series C in 2018. Since then, we led the Series C-2 and convertible note and most recently participated in the company’s $125 million Series D. Energize managing partner John Tough holds a board seat and is the lead director, and principal Tyler Lancaster is also an observer on Volta’s board. In addition to these contributions, Jim Murphy, the President of Invenergy and a member of Energize’s investment committee, actively worked with Volta management to run their project financing process in 2019. Energize is very thankful to be a partner to Volta, and we are excited to continue to support the company through their next step.

Congratulating Volta on the next step

Volta builds and operates a network of EV charging stations that are among the highest utilized in the United States. Strategically placed in front of essential businesses such as grocery stores, pharmacies, banks and hospitals, Volta’s EV network supports a larger consumer trend toward vehicle electrification by placing fueling stations in parking lots directly where consumers already spend their time and money. Currently located in 23 states and over 200 municipalities, Volta’s unique approach has gained significant acceptance and penetration in the market.

We believe that Volta has a tremendous opportunity to be a household name in the next generation of mobility. This growth requires large capital investments into new charging infrastructure, and this SPAC transaction will help capitalize Volta to #driveforward.