Sunday Sales Series 3 – Utility Scale Solar O&M

This will be a 4-part mini-series on utility scale O&M. There are 4 different types of O&M where standardization is occurring:

- Utility Scale Solar: priced per MW

- Utility Scale Wind: priced per turbine

- Utility Scale Distribution: priced per pole, or per mile inspected

- Still developing segments: battery O&M; utility-owned rooftop O&M

I am starting in O&M as these prices are the most standardized. After this 4-part series I will get into utility scale construction contracts for these assets. And will end with development costs, as the development stage still has very little consistency and is where the largest value arbitrage still exists for software providers.

Part 1: Utility Scale O&M – 🌞 SOLAR ☀️

The average utility scale solar site is massive. 1 MW solar capacity site takes up about 2-4 acres. A few years ago a 100MW solar site would have been award-winning. But now renewable energy developers are routinely developing mammoth solar sites between 400MW to 1 GW+ in size.

As a result of the the increase in scale, a utility scale solar farm will sprawl between 300 to 3,000 acres. The size of the projects require new technology solutions.

How did O&M inspections use to happen?

Techs would walk a site every year. They would inspect each panel with a thermal imaging ray gun and look under each panel to make sure a wire routing to the inverter wasn’t busted or eaten by a pesky animal. For a 100MW site, two techs would cover the asset twice annually. Not only is this incredibly inefficient, but the remote conditions actually make for unsafe work environments.

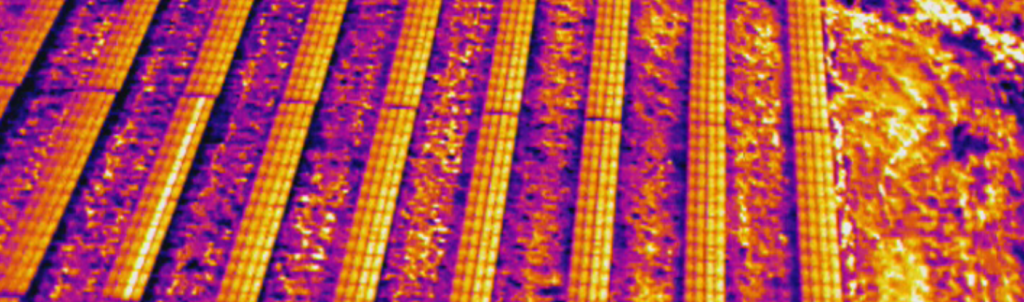

The above photo is captured from a drone that has a thermal camera attached. The thermal camera immediately informs a pilot and operator which panels are not operating correctly.

The FUTURE

A drone’s ability to cover massive amounts of land in relatively short time periods, all while allowing a pilot to be more secure has made the product a perfect fit for the renewable energy industry.

For sake of simplicity, I am going to use a 100MW solar site as an example. (About 300 acres in size) Most operators of renewable scale solar are looking for monthly inspections. And the price range for a fully-baked service is around $300 per MW per year. This breaks down into:

$300 per MW * $100MW site = $30,000 drone pilot & drone-related aerial analytics

While most large-scale operators are now building their own drone fleets, the cost above assumes an outsourced drone pilot. A drone pilot for that scale is about $500 per flight: so 12 flights is $6,000 for the year in drone pilot costs. Removing this $6,000 from the $30,000 per site opportunity yields approximately $24k in revenue available to the aerial analytics platform powering the solar inspection, or about $240 per MW/year.

In 2020, analysts expect over 12 GW of utility scale solar to be installed in the US. This growth equates to $3.6M in new aerial analytics software contracts becoming available as these new utility scale solar farms energize in 2020.

Given how comparable the unit of pricing is here, there has been incredible competitive pricing pressure in this figure over the past 2-3 years. Aerial analytics firms focused on O&M in renewables used to get $600+ per MW flown. For this reason, I suspect we will continue to see this O&M price drop down closer to $50-100 per MW annual pricing on the O&M side.

The upside, of course, is that even at this reduced pricing a 1 GW site still creates a $50-100k/year software opportunity.