The Energy Transition May Force Petrochemical Growth

The next most logical investment in the energy transition is to continue to develop balanced renewable energy sources. At this point, the Levelized Cost of Energy graph is commonplace and the final chapter of the LCOE story is well-written: Step 1- we will decarbonize most of power generation …and as a result… Step 2- most of the mobility market as electric vehicle motors overtake internal combustion engines.

However, focusing exclusively on continued investment in wind, solar and batteries is not taking into account that this energy transition is a multi-player, rules-changing game, with a specific player who can walk to a different table at any time. Why? Natural gas is still an economics-driven commodity, and a versatile one at that.

Natural gas is a commodity that has both thermal value as a power generation resource and chemical value as a feedstock for higher value consumer products. As demand for natural gas decreases in power generation, supply remains high, and new use cases emerge.

Consumer packaging, rubber tires, hand sanitizer, and millions of other CPG products all come from natural gas. And because natural gas is so abundant in the U.S., it is actually cheaper to make these petrochemicals domestically and ship them to Europe and Asia than it would be to produce them in those regions.

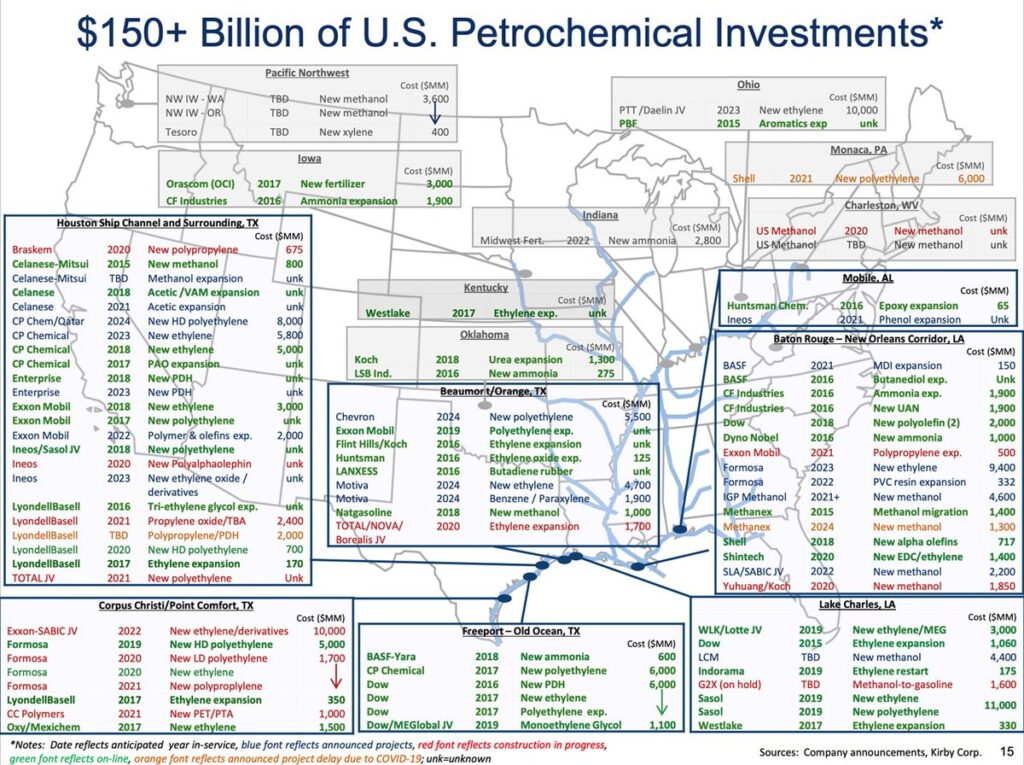

The graph below shows there is $150BN of petrochemical capital expenditure investments underway in the U.S. right now and almost all of these assets are being built to EXPORT a natural gas byproduct. This new construction is in addition to the ~$750BN of existing petrochemical assets already in the ground here in the US. For perspective, the $150BN of investments is 10x greater than the size of the $14BN US wind energy 2019 investments!

These petrochemical investments will be a consumer of our energy resources for decades to come, and therefore deserve their place on our “attention shelf” when evaluating the Energy Transition. Mark Tomasovic of the Energize Ventures is helping us understand this petrochemical dynamic and identify how our financial and impact missions can positively address this market.

We are also looking to understand how better recycling technologies s can be created to improve upon the (meager) 7% of plastics that actually get recycled.

If you are an entrepreneur looking to positively address this market with digital technologies, please reach out.

— and very timely, just today there was an article in the NY Times on the petrochemical and fossil fuels industry trying to make Kenya and Africa a distribution center and destination for US plastics. Here are a few quotes:

”The plastics proposal reflects an oil industry contemplating its inevitable decline as the world fights climate change. Profits are plunging amid the coronavirus pandemic, and the industry is fearful that climate change will force the world to retreat from burning fossil fuels. Producers are scrambling to find new uses for an oversupply of oil and gas. Wind and solar power are becoming increasingly affordable, and governments are weighing new policies to fight climate change by reducing the burning of fossil fuels.

”Pivoting to plastics, the industry has spent more than $200 billion on chemical and manufacturing plants in the United States over the past decade. But the United States already consumes as much as 16 times more plastic than many poor nations, and a backlash against single-use plastics has made it tougher to sell more at home.”