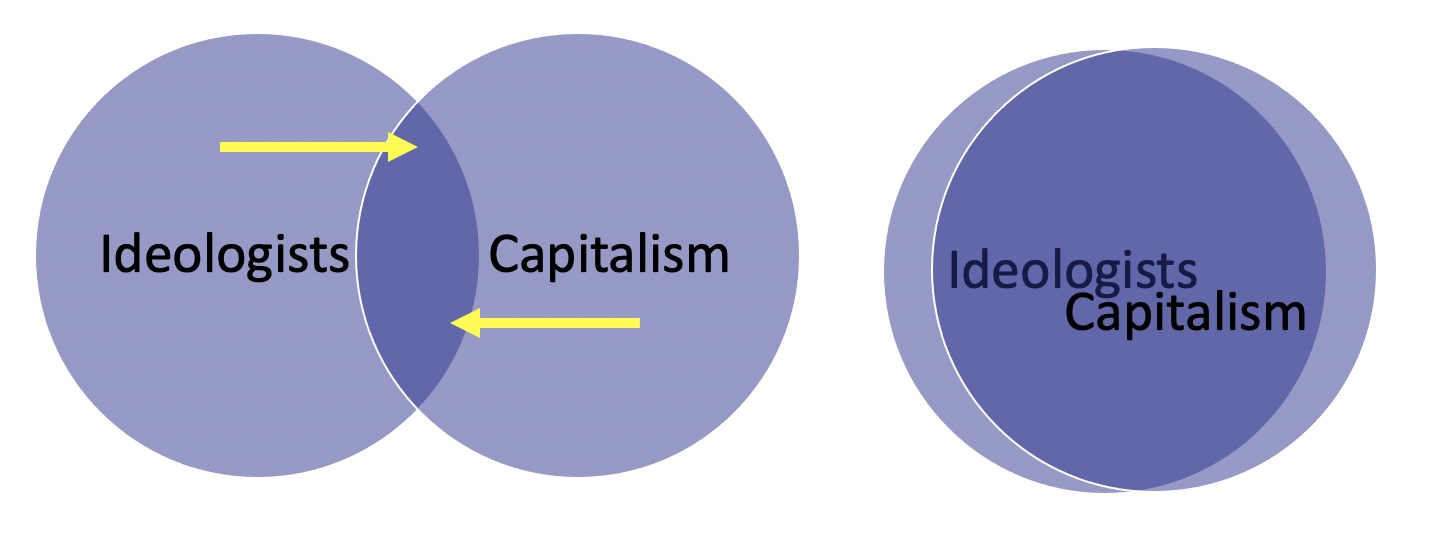

When Ideologists and Capitalists Align

Until recently, sustainability ideology and capitalism were two circles with only minor overlap in a Venn Diagram. Outside of minor fads, the two groups never saw eye::eye and financial returns were (expected) to be sacrificed for an investment in sustainable advancement.

The latest surge of interest in climate solutions, highlighted by:

- Tesla’s stock surge

- Array Technology’s record breaking IPO and secondary

- Record breaking wind, solar and battery deployments

- SPACs of new electric vehicle platforms, and autonomous solutions

- Hydrogen interest

- Additive manufacturing interest

- Carbon-free flight

- Financial leaders demanding ESG responsibility

…, is what happens when the circles of ideology and capitalism become concentric. As a result of this convergence, the infrastructure of our world is being reconstructed with sustainability technology, solutions, and products. And for the first time, the financing partners are making these investments with no expected sacrifice to returns. In fact, the opposite where these businesses are now the expected source of growth in our economy.

There is arguably no bigger stage than the infrastructure markets. Therefore, the capital required to effect change – and the potential impact of that change is of an unimaginable scale. As a result, the flow of capital into sustainable technology and solutions has moved from a drip to a firehose. If you think about the scale of our physical infrastructure, then the recent spate of SPACs and investor interest is still relatively low compared to the global interest is these new solutions.

I remain incredibly excited about the change underway and believe that the pace and scale of these new technologies will define the (roaring) 2020s and beyond.