Energize invests in TWAICE

Energize Ventures is proud to lead the oversubscribed $26M Series B investment in TWAICE, the leading software platform for battery analytics. Existing investors Creandum, Cherry Ventures, Speedinvest and UVC also participated in the round. Energize principal Tyler Lancaster joins TWAICE co-founders Stephan Rohr and Michael Baumann on TWAICE’s board, and associate Mark Tomasovic joins as a board observer. This investment marks Energize’s first investment in the battery sector and our third investment in a company based outside of the U.S.

“With the rapid acceleration toward electrification, we are keen to grow in key markets. North America is the logical next step.” With its impressive portfolio of energy and mobility companies and strong footprint in the United States, the new investor Energize is the ideal partner”

Stephan Rohr, Cofounder & Co-CEO at TWAICE

Our “Why We Invested” is pasted below.

Software, soft costs and scalability

The economics of renewable energy and the demand for electric vehicles are accelerating a global transition towards mass electrification. As the world electrifies, batteries will be needed to move electric vehicles and smooth the power supplied to the grid. TWAICE’s software brings transparency to the battery lifecycle, optimizing both the development and operation of batteries.

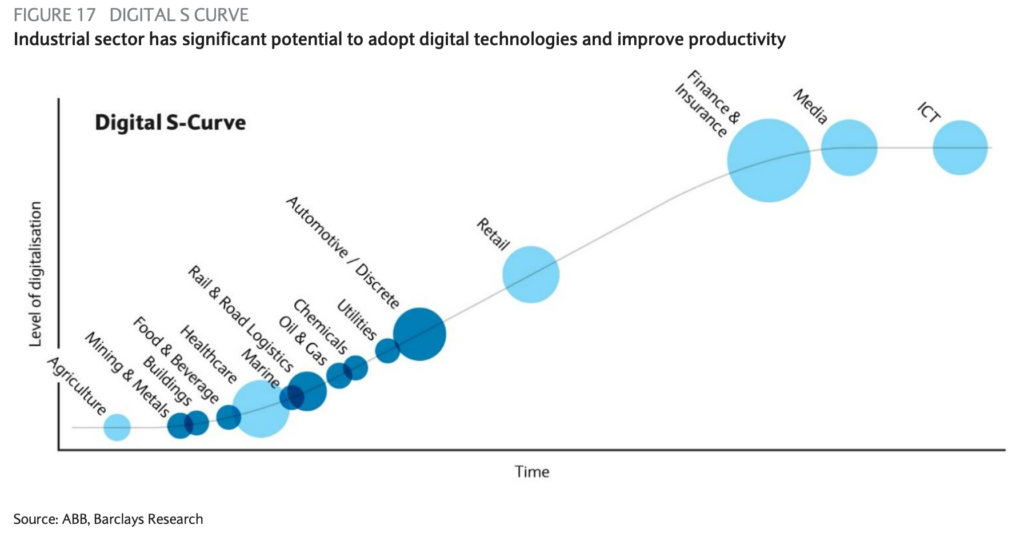

After years of closely monitoring the energy storage ecosystem, Energize recognized that software will be critical in helping the battery industry achieve scalability. The world is at an inflection point in both global electric vehicle sales as well as energy storage deployment. The serviceable market for battery analytics is expected to grow at a 48 percent CAGR over the next five years.[1] While the cost of battery hardware has declined by 80 percent since 2013, “soft costs” will inhibit further scale by slowing system-level battery cost declines. Inefficient battery sizing and design, ineffective customer acquisition, and suboptimal charge and discharge cycles all add soft costs — hindering broader battery storage and electric vehicle adoption.

TWAICE’s software platform significantly reduces soft costs, making renewable energy and electric vehicles more economic. By helping customers understand the degradation of energy storage assets over time, TWAICE enables users to improve up-front battery sizing and actively manage storage assets — which can extend battery life by more than 25 percent. Our investment in TWAICE is the culmination of the ideal market conditions, technology, and team. The energy storage sector is poised for sustained growth over the next decade, and we expect to see escalating demand for the company’s proprietary battery analytics platform.

Solutions-oriented team

Energize has been evaluating the battery software market for more than four years. The Energize team first met TWAICE co-founders Stephan Rohr and Michael Baumann as they were spinning out the company from the University of Munich. During their PhD studies in battery engineering, Stephan and Michael realized that battery design and degradation were becoming emerging pain points in both electrified mobility and renewable-power generation. However, existing internally-developed or consultant-generated analytics were too costly and could not scale with the battery industry’s exponential growth. Stephan and Michael began building a tool to model and simulate battery performance. Soon after, TWAICE was born.

Over the past three years, TWAICE has assembled an incredible team of product designers, engineers, and machine learning experts to accelerate battery development, monitor battery health, and accurately predict future performance.

What’s next: International expansion and industry-specific growth

TWAICE and Energize see a tremendous market opportunity for software to drive efficiency across every aspect of the battery lifecycle. With the Series B raise, TWAICE plans to scale operations in Europe, begin commercialization in the U.S., and expand product functionality by building industry-specific solutions on top of their core analytics platform. In addition to capital, Energize is excited to bring our network across the energy and mobility industries and our experience scaling industrial SaaS companies. We are thrilled to partner with Stephan, Michael, and the broader TWAICE team!