Honeywell and Salesforce-built Sparta Systems

The “built on Salesforce” technology stack now has a number of winners.

The original and most epic example is Veeva Systems. Veeva took less than $10M of capital, and is now a $41BN value company. The company was so efficient because it leverages the Salesforce infrastructure to build a vertical-specific solution. In the process, Veeva’s additional application layer gave hospitals and healthcare firms greater value… and charged a boatload more. The company has $1.4 billion of trailing twelve month (TTM) revenue and $340M of operating income. This represents a 30x revenue multiple and a

Since then, many other firms have come forward:

nCino is also built on Salesforce’s platform. nCino used the basic infrastructure and built a banking and finance focused operating system. The company is now a $7.4 billion public company with $170M of LTM. Not a shabby 40x multiple.

Conga and Apptus were some of the earliest platform adopters. These companies, now merged, have nearly $500M in TTM revenue and provide contract lifecycle management.

Today’s announcement by Honeywell brings another “Built on Salesforce” company to the forefront. Honeywell announced the $1.3 billion acquisition of Sparta Systems. The target company’s ore product is a quality management software delivered as a service with artificial intelligence. According to their website, Sparta Systems has “two primary platforms include TrackWise Digital, which is built on Salesforce’s platform, and QualityWise.ai. QualityWise.ai brings natural language processing, signal detection and confidence levels for recommendations to TrackWise Digital.”

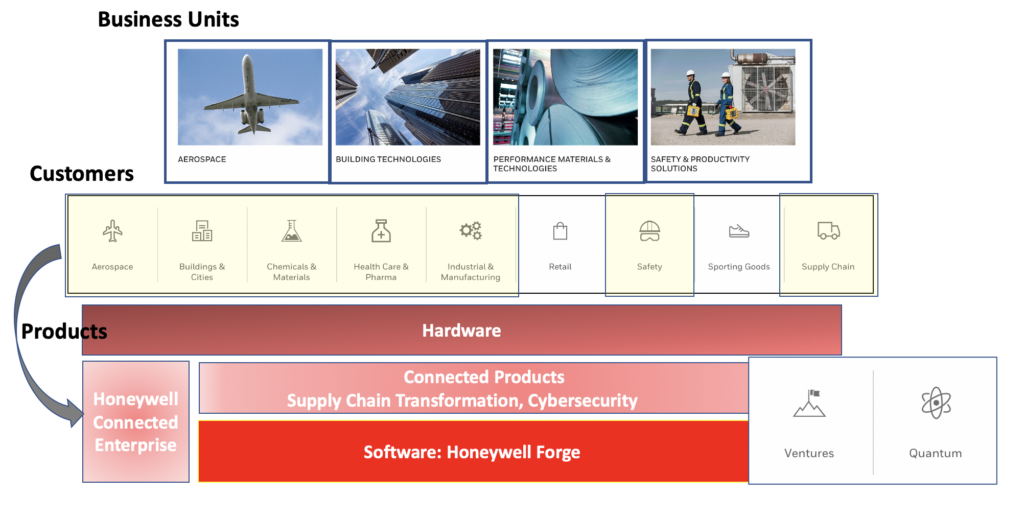

The product will integrate with Forge, and the M&A is consistent with my past analysis of Honeywell’s digital strategy. Perhaps the most important part of the narrative, however, is Honeywell’s continued integration with traditional IT firms as Honeywell is already cozying up with Microsoft and now Salesforce. Given that Salesforce (and Microsoft) are where existing industrial customers go to shop for IT, Honeywell is wisely associating their OT stack.

With the $1.3 billion price tag and the other recent comps listed above I suspect Sparta Systems had somewhere around $40-90M in revenue. As the company has more implementations (non-software) revenue I suspect Honeywell paid a slightly lower multiple and the company had $60-90M of revenue.