Consolidation at the top of industrial sensor market: Teledyne Acquires FLIR Systems

I am trying a slightly different format for this announcement. Because this is a slightly different type of M&A event I usually cover.

The industrial environment is now rife with cameras, sensors and lasers. Yes, the same infrared and LIDAR technology on your new iPhone is now present across manufacturing, energy and critical infrastructure sites across the world.

An example of the products can be seen here: infrared cameras, thermal screening cameras, lasers, and high performance digital capture.

Yesterday, FLIR Systems announced they were acquired by Teledyne for $8 billion. Why is this relevant?

The Acquired: FLIR

Founded in 1978, FLIR is a world-leading industrial technology company focused on intelligent sensing solutions for defense and industrial applications. FLIR’s vision is to be “The World’s Sixth Sense,” creating technologies to help professionals make more informed decisions that save lives and livelihoods

The Acquiror: Teledyne

Teledyne is a leading provider of sophisticated instrumentation, digital imaging products and software, aerospace and defense electronics, and engineered systems

What makes this transaction unique is both the scale and the potential synergy. Here are some facts:

Teledyne has $3BN of revenue and is valued at $14 billion. FLIR has $2 billion of revenue and was acquired for 4x revenue. This makes the combined company an approximate market cap of $22 billion – a stalwart of the industrial and defense sensor market.

The transaction is unique in that Teledyne expects the acquisition to be immediately accretive to results – an incredibly rare M&A feat in the industrial technology products world. This accretive expectation shows that the firms serve complementary markets and can leverage a consolidated back office.

The Executive Chairman of Teledyne summarized the complementary nature well:

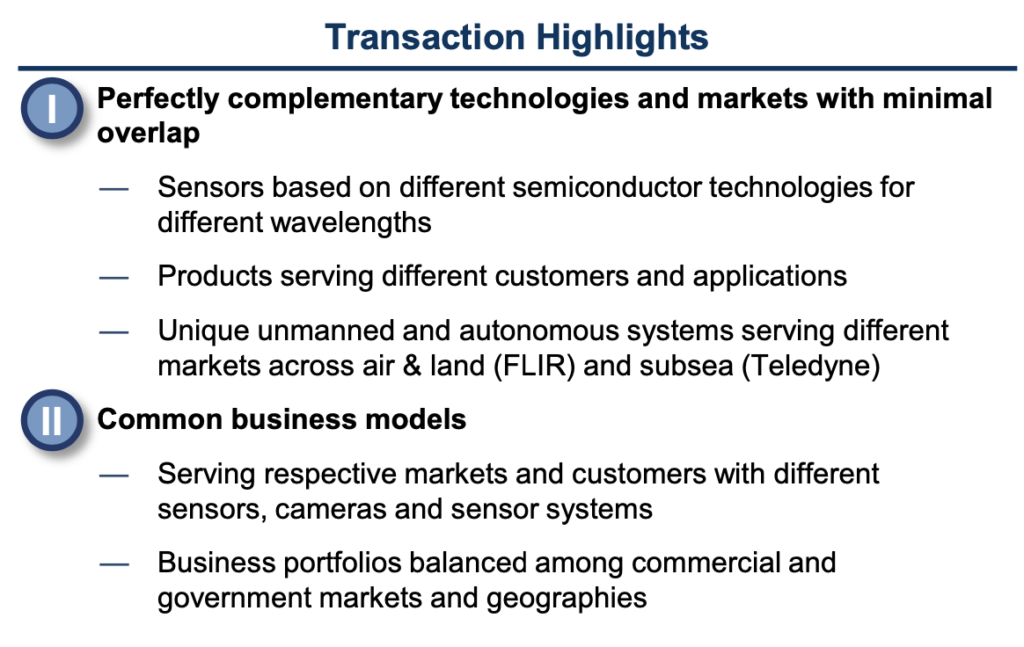

At the core of both our companies is proprietary sensor technologies. Our business models are also similar: we each provide sensors, cameras and sensor systems to our customers. However, our technologies and products are uniquely complementary with minimal overlap, having imaging sensors based on different semiconductor technologies for different wavelengths. For two decades, Teledyne has demonstrated its ability to compound earnings and cash flow consistently and predictably. Together with FLIR and an optimized capital structure, I am confident we shall continue delivering superior returns to our stockholders.”

Robert Mehrabian, Executive Chairman of Teledyne

Here is a summary of the complementary product suite

On the financial side:

Teledyne acquired FLIR for ~4x 2020 revenue. FLIR also had ~20% operating margin and a dividend. Net, the company had a strong profile within the industrial technology industry. However, growth was neutral to slightly up. Given the growing demands for industrial (and defense) sensors, I suspect the Teledyne – FLIR combination is well-positioned to capture market share while sharing backing central services and R&D resources.

Valuation: Growth /Margin Trade-offs

As a venture investor, the moderate revenue multiple for a low-growth/higher margin company is a reminder that growth is currently rewarded with greater multiples in the public markets than margin. For example, if FLIR was growing at >10% with a slightly lower operating margin, I would imagine FLIR would have received a higher M&A offer. I have to admit that this remains an anomaly to me as I see the FLIR profile as a strong brand in a consistent market that has customers committed to the FLIR product line.

They NEVER mention software…??

Finally, none of these companies talk about software in their press release about the transaction. That is crazy. I believe there will be many very valuable software companies in the computer vision/ digital imagery sphere that operate within the industrial and built environment. If you know of any in this area, please let me know.