Own the Demand, Pt 2: The Energy Transition Can Learn from Amazon

This is Part 2 in my series about what it means to “own the demand”. On Wednesday I wrote Part 1: why the energy market changes are making it increasingly important for energy companies to move from a supply mindset to a demand mindset.

Summary

As the world moves to oversupply of power, the smartest energy companies will move from balancing centralized supply and demand, to providing the products and controls for decentralized customers to manage their own supply and demand.

Why? With the decentralization of energy, the customers’ energy products and energy software needs are going to quickly mirror the needs of the utilities themselves.

Therefore, I believe that the winning energy companies are going to find a way to productize their internal IP on proprietary subject matters into more modular tools for 3rd party use. The most advanced energy companies will be comfortable doing joint ventures with technology companies (or buying them) to help bring the software-specific tools into the fold. As a result, the production and load management will move to the edge. And the energy company will own the remote production and control layer.

Amazon provides a great precedent here. They have taken internal cost centers, productized them, and made them available for 3rd party use and revenue.

How to Learn from Amazon

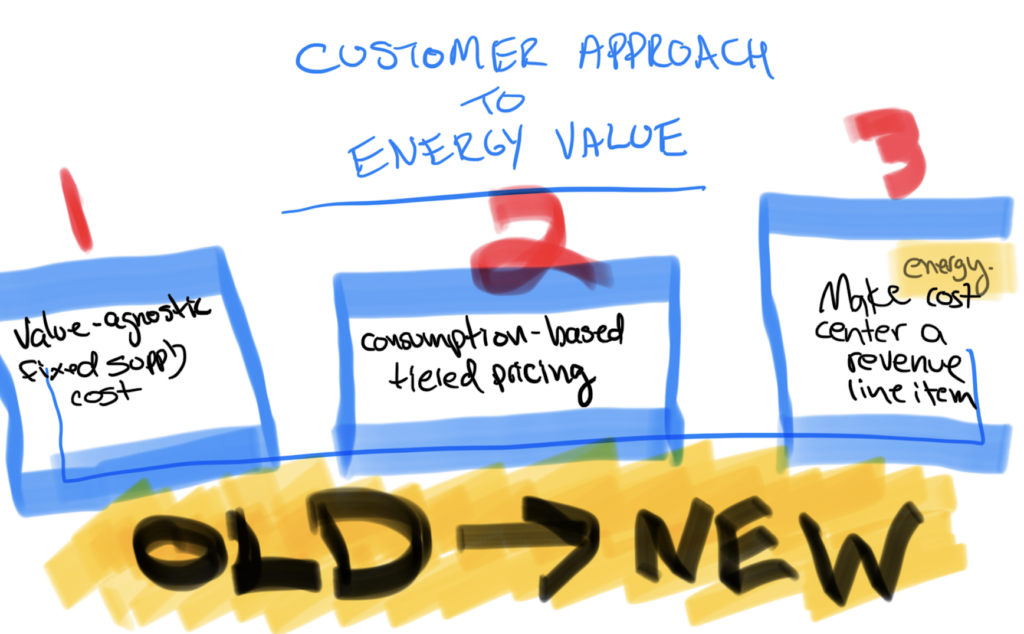

In the above graphic, energy companies currently make money in business model #1 (fixed supply price) and business model #2 (consumption-based tiered pricing). I believe that our oversupply of power is going to enable a 3rd business model: productize internal utility energy tools that are currently a cost center and distribute them as a form of new revenue. Luckily for us, there is another firm currently executing this cost center -to- revenue transition masterfully that we can learn from…

How we Learn from Amazon

The analysis (via Tweet) above was from Shai Dardashti, and showed how Amazon turned internal cost centers into productized, 3rd party tools. These repurposed technology assets met a customer need. Therefore, Amazon found a way to turn their cost centers into revenue line items. Amazon accomplished this goal because they knew their customers had the same technology needs as Amazon itself.

Given the increasing decentralization of energy, the energy products and energy software needs of customers are going to quickly mirror the needs of the utilities themselves. The types of solutions that end-consumers will start to seek include more modular and repeatable versions of the following:

- Load balancing software for distributed energy management

- Energy systems design and bid management: solar, battery, microgrid

- Easily purchasable long-term power purchase agreements with nearby utility scale power

- On-site renewable generation installation

- Onsite renewable generation quality assurance, insurance

- On-site power efficiency and weatherization modeling

- Power supply optimization /cost management

- Pricing mechanisms for peer::peer or 3rd party power sales

- Notifications platforms for demand response for optimal pricing

- Cogeneration for waste capture or other baseline support

- EV charging infrastructure and systems modeling

- EV charge-time management, load balancing

- EV fleet logistics, charging and balancing

- Power quality assurance

- Outdoor and long-range network communications tools

- Cybersecurity and network management controls

- Easily bookable, verified and reputable operations & maintenance electricians/technicians

- Decommissioning and relocation services

Utilities offer many of these services for their own assets and networks, and to their largest consuming energy customers. The utilities use these tools to help match supply and demand. As the world moves to oversupply of power, the smartest energy companies will move from balancing centralized supply and demand, to providing the controls for decentralized customers to manage their own supply and demand.

I believe that the winning energy companies are going to find a way to productize their internal IP on these subject matters into more modular tools for 3rd party use. The most advanced energy companies will be comfortable doing joint ventures with technology companies (or buying them) to help bring the software-specific tools into the fold.

A successful outcome here is to help each energy consumer manage their power load through deliverable technology. For most individuals, 1-2 of these tools will suffice. But as renewable generation, EVs and batteries become commonplace, more complex software tools and products are required to balance each edge location. For example: if a local businesses’ microgrid needs to communicate with the neighborhood battery system, a new suite of software-defined data networking tools need to be built to allow instructions to be sent between the assets. And to trust the communication layer for that network, we now need a purpose-built network management and cybersecurity tool to ensure no false signals or nefarious actors.

Over the coming days I will be walking through these examples – and specifically around one firm that has placed themselves at the center of the transition.