Big growth, cash flow positive… and raising equity?

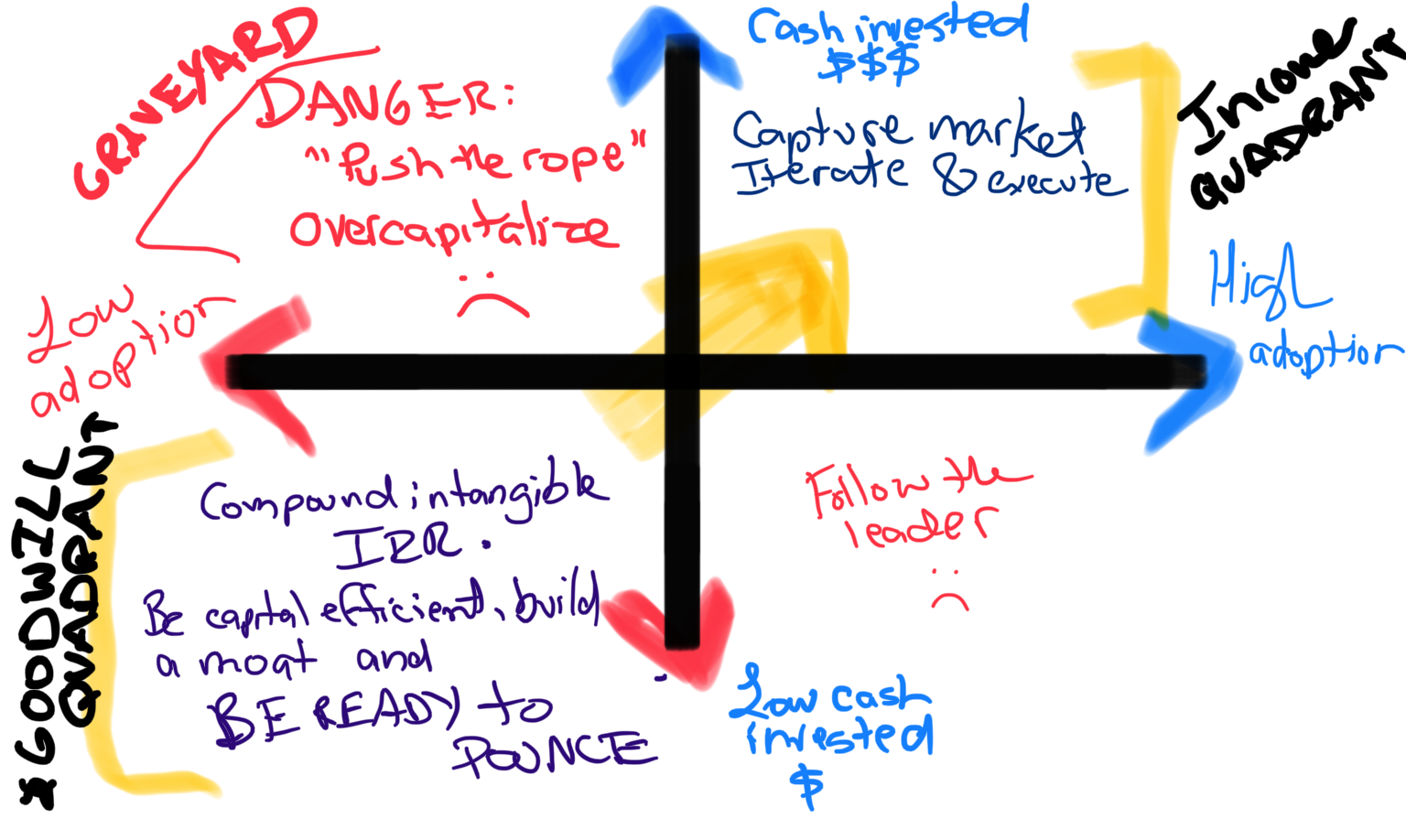

Over the past few months I have seen a few software companies serving the energy and industrial verticals with this head-turning profile: + $5-10M of revenue + >200% YoY revenue growth + Profitable + Sizable cash balance My first thought when seeing these companies? Wow, this scale of efficient growth wasn’t happening before. My second …