Sales Efficiency Drives Valuation Premiums

Public market valuations are near all-time highs. There are many studies that show how valuation multiples are tied to growth rates. But the public market investor is getting wiser to the cost inputs required for growth.

This week I saw a great report from Guggenheim on the correlation between valuations and growth efficiency.

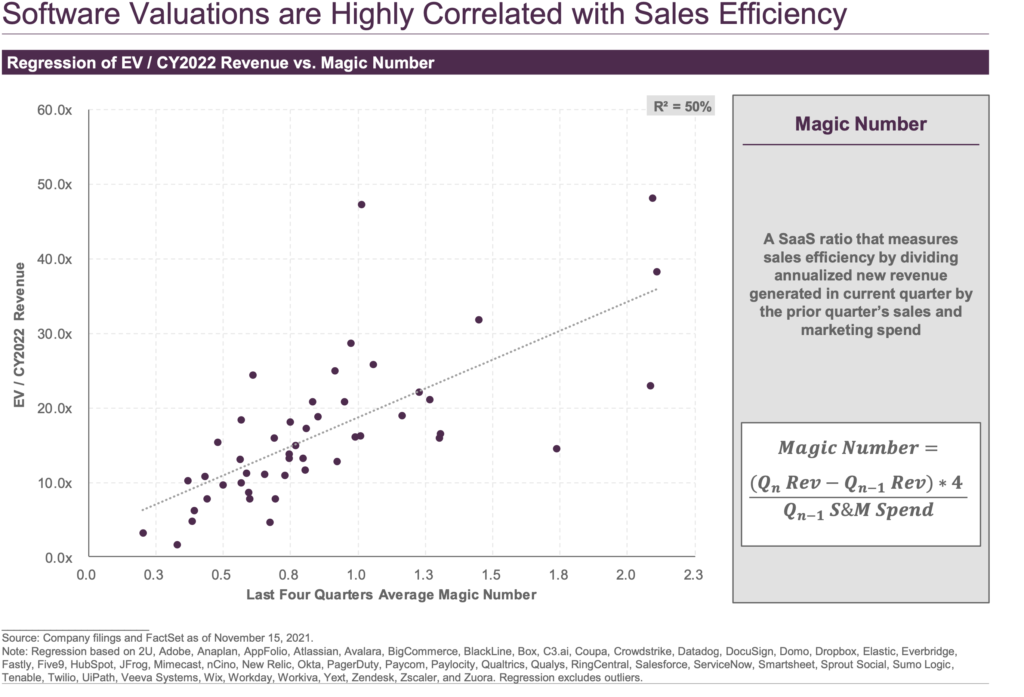

On page 1, we find that sales efficiency, specifically the magic number (the ratio of new revenue generated to Sales & Marketing spend) has a strong correlation to valuation. The more efficient the sales motion (higher the magic number), the greater the valuation.

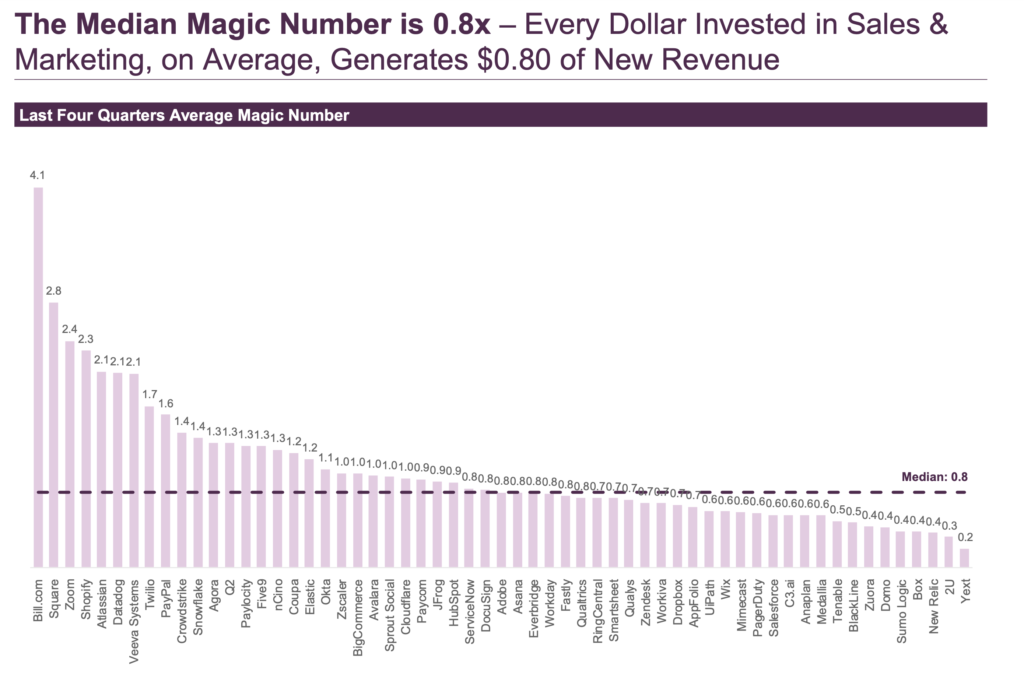

On page 2, they line up magic numbers across software and find that the median is 0.8x, meaning that on average software companies generate $0.80 of new revenue for every dollar they spend on S&M. Driving sales efficiency above $0.80 should also drive above average valuation, holding all else equal.

Basic stats but helpful framing as growth-stage companies consider going public.