SunRun Rising: A Top Energy M&A Target Emerges

I posted this post to Forbes as part of my regular M&A and energy transition observations. Link here. Re-posting here.

We all know TeslaTSLA is the current crown jewel of the automotive industry. And investment analysts know of the budding traditional energy business growing like a weed within the Tesla income statement. Alongside their sleek cars, Tesla has rooftop solar and consumer and utility-scale batteries. Tesla makes energy tangible and cool.

While Tesla’s market position in the EV space is strong now, the competition is coming. Sure, they will be able to maintain slightly higher margin than their historical automotive peer set. I argue, however, that being the energy company of the future is a much more lucrative position.

And Tesla’s real competitor in that next-generation energy business is SunRunRUN. They have a strong brand, a growing book of business, and they have a direct line of site to their customer with up to 20-year contracts.

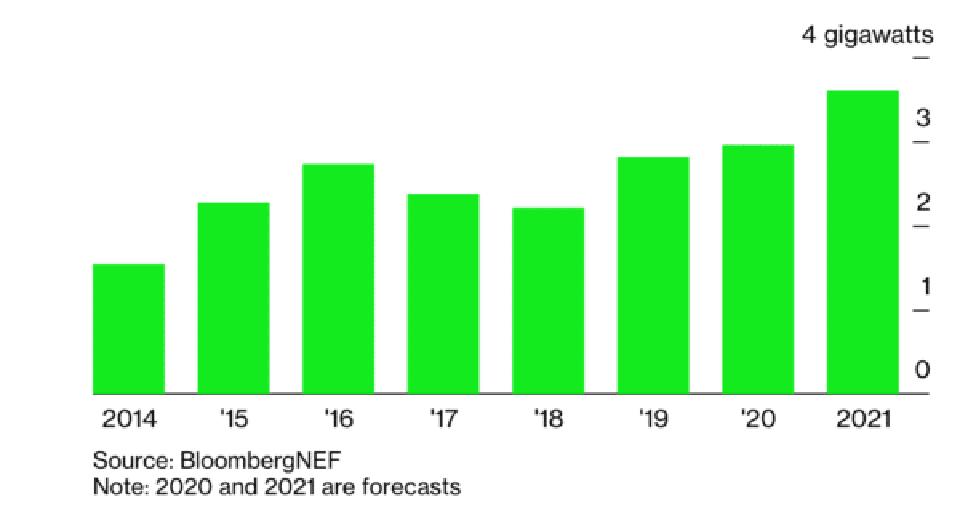

Presently only about 3%, or 2.3 million homes in the US have installed rooftop solar. But rooftop solar is growing: SEIA and Bloomberg New Energy Finance guide that installation will grow from ~500,000 per year n 2020 to 2-4 MILLION per year by 2024. Yes, you are reading that correctly: we should be adding more solar rooftops in 2024 than we have throughout the entire history of our country leading up to that point.

Solar is a “long-tail” industry meaning that there is an incredible number of small, regional installers doing the majority of the work. As a result, SunRun is the leader but actually only owns ~10% of market share in the US, with a 60,000 installation run-rate in Q3 2020. And most interestingly, SunRun’s installation base is nearly 2x the size of Tesla.

If SunRun can hold or expand their market position as the rooftop solar industry grows, the firm should become one of, if not, the largest energy companies in the country. SunRun currently has 500,000 current customers and a customer book that could start growing by 250,000 per year. Within the decade they will be a “top 5 utility equivalent” in North America. Since SunRun will “own” that customer relationship, I expect that they will be well-positioned to be more active in the other home solutions including electric vehicle charging, batteries and other resilience solutions.

From a M&A perspective, I believe SunRun is an incredibly strategic asset within the North American energy markets. They have a strong and growing brand and are well-positioned for other distributed energy services. SunRun should be on the top of the target list for any forward-thinking traditional energy company. Similarly, if any enterprising automobile company is looking to create the next bundled mobility + energy company, they don’t have to look any farther than SunRun as their optimal partner.