The ‘Goodwill to Income’ Framework: Being Early isn’t the Same as Being Wrong

In start-ups there is a common phrase: “being early is the same as being wrong“

That statement is wrong.

Here is a correct version of that phrase: “Being early and spending like you are on-time is the same as being wrong”

From an entrepreneur’s perspective: if you are passionate about a space and you want to dedicate a portion/majority/all of your professional career to an opportunity, then being “early” is just the learning process. Perfecting the skillset or complementing the knowledge base as the opportunity evolves. The early stages are where you can compound domain expertise and network advantages.

From a VC perspective: being early is being wrong only if VCs overcapitalize the business due to HOPING the market is ready now.

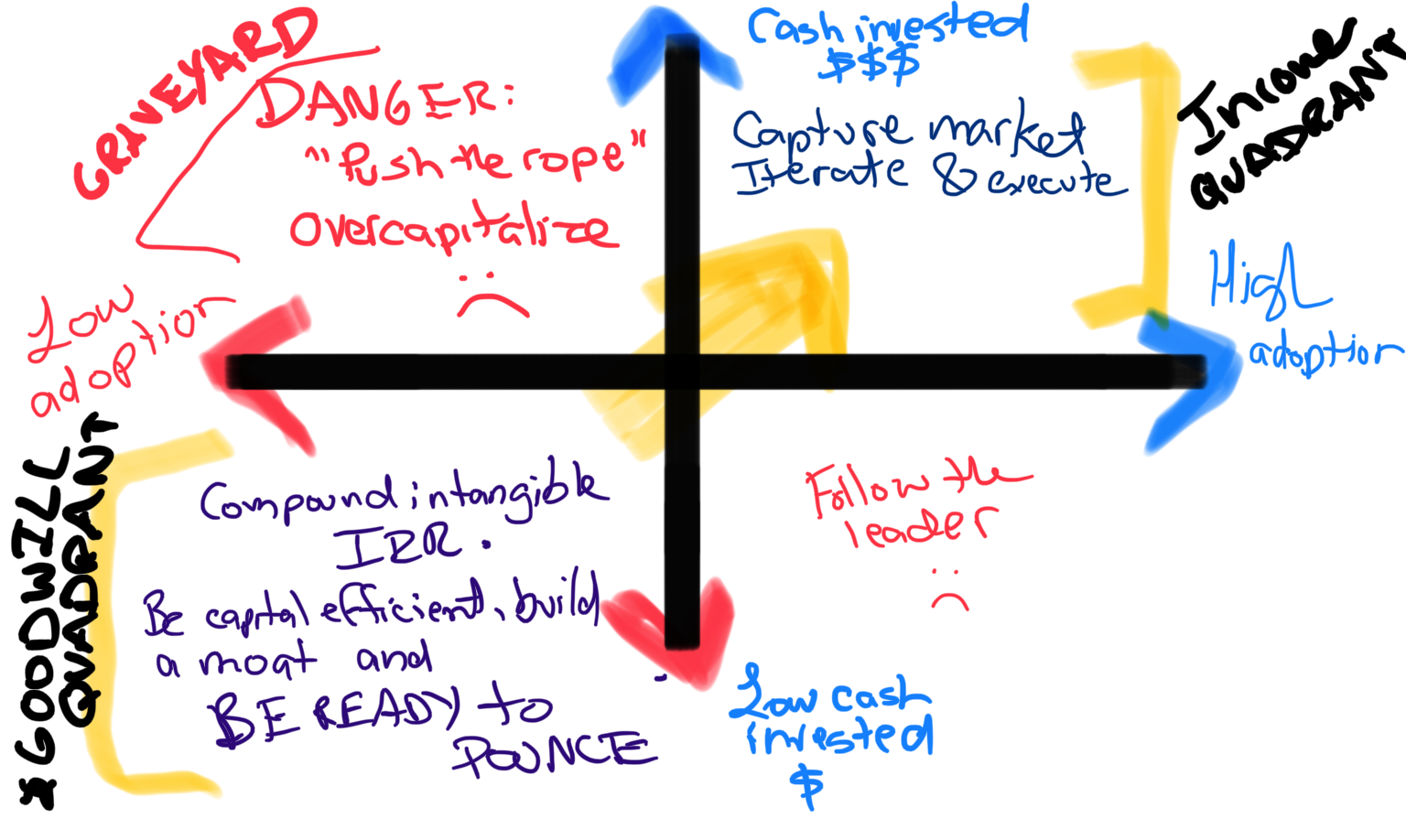

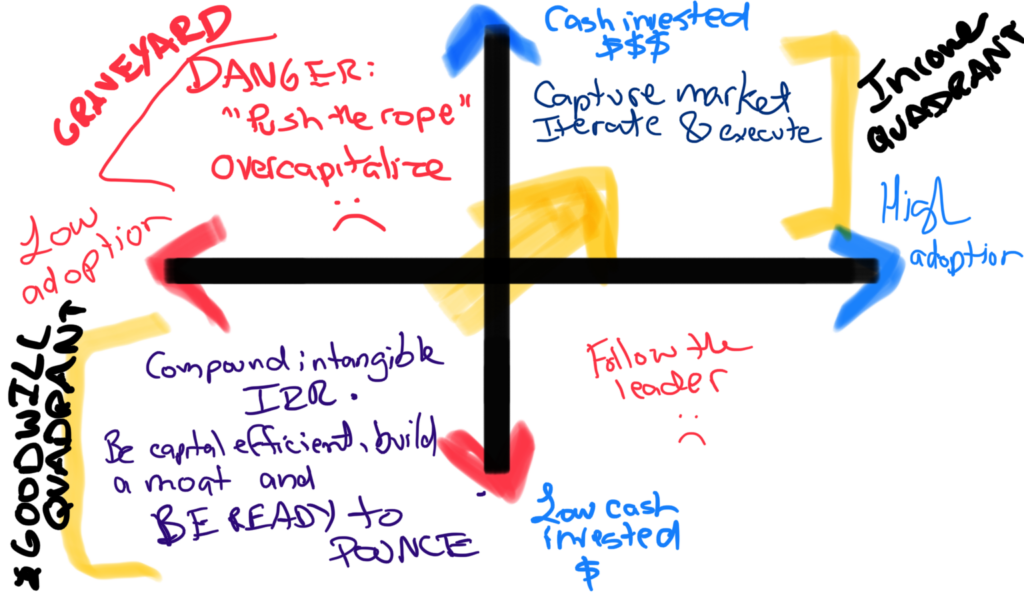

I approach market readiness with a “Goodwill/Income” Mental Framework

Goodwill Stage: returns are primarily intangible, including expanding domain expertise, market know-how, network growth, talent acquisition, discovering the nuance and improving the product’s advantage

Income Stage: Intangible returns continue, but the primary focus of the start-up and market turns to customer adoption and results in revenue and profit KPIs

The latter “Income Stage” growth is what receives most of the focus because the scorecard is more visible. But the compounding returns of the Goodwill Stage are the most powerful part of a businesses’ development. This can occur pre-revenue or in operating pivots as a market evolves. Either way, the scorecard is less trackable.

In our market, the best start-ups remain cash efficient and have excellent IRRs in their Goodwill state. And then the company steadily leans into the post-commercial growth indicators. Time and again I see overcapitalization because a founder or VC wants to believe an opportunity is now. My answer in those cases is for the entrepreneur to stay lean and continue compounding the goodwill side of their growth equation.