Energize Leads $22M Series A into SINAI Technologies

One of the key themes for Energize over the past 2 years has been the decarbonization movement. As covered in the past, we like to identify megatrends and then search out the capital light / digital solutions that will help deliver the impending scale. We have made investments in companies like Patch (API enabled tools and marketplace for carbon markets & related credits), NCX (high value carbon offset verification and origination) .. and now are announcing our third investment… into Sinai! More details on the company are below. I am particularly pleased as this is Eileen Waris’ first board seat representing Energize, and she and Lauren Densham are true leaders on the decarbonization and impact themes.

Energize Ventures is proud to lead the $22 million Series A investment in SINAI Technologies, the decarbonization intelligence platform, marking our third investment in carbon market infrastructure. Energize is joined by Stardust Equity and HighSage, along with previous investors Obvious Ventures, Valo Ventures, Afore and High Alpha. Presidio Ventures, NEC Translink Capital and Singtel Innov8 are also participating. Energize principal Eileen Waris joins SINAI’s board as a director and Lauren Densham joins as a board observer.

The winding road to net-zero

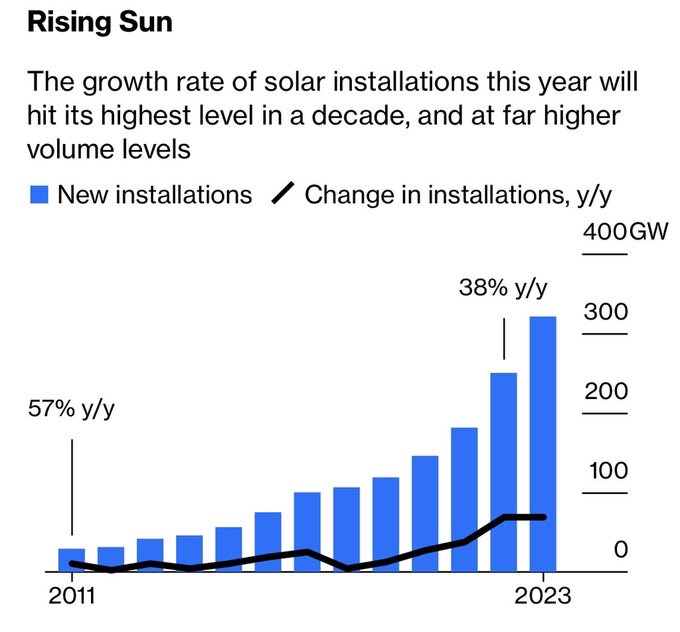

The need for a decarbonized economy becomes more evident with each extreme climate event. While research and development around new decarbonization technologies are critical, many solutions already exist—as Energize has discussed at length in our Electrifying Everything series, up to 70 to 80 percent of U.S.-based emissions could be addressed with technologies that are proven and economically viable today.

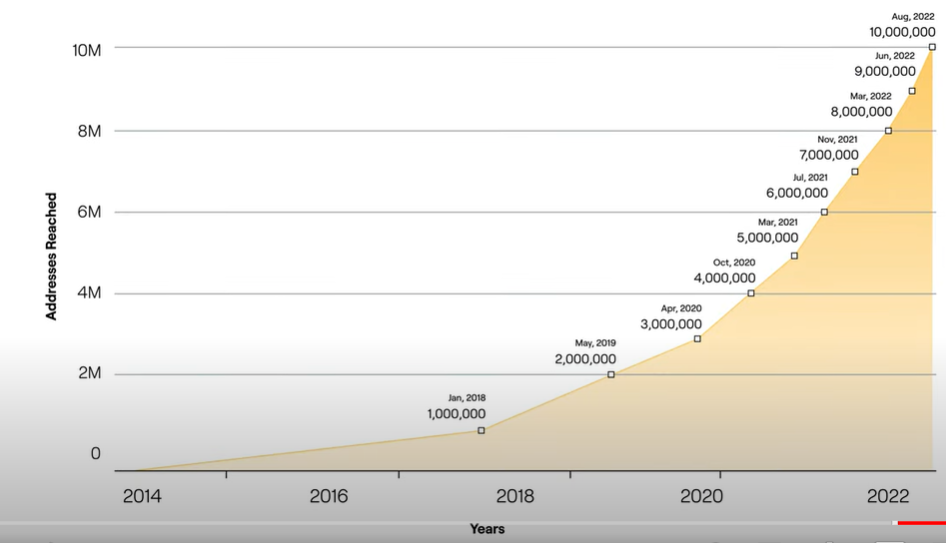

While the appetite for investing in and implementing sustainability measures is growing steadily, the challenge lies in deployment. As of December 2021, 21 of the 30 largest U.S. and European oil and gas firms, 26 of the 30 largest U.S. utilities, and all 30 of the largest American, Canadian and European banks have made net-zero commitments, according to an S&P Global Market Intelligence Analysis. Yet based on reporting from June 2022, two-thirds of global companies with net-zero targets haven’t disclosed how they plan to reach their goals. Despite readily deployable technology and public pledges, most companies still don’t know where to begin when it comes to decarbonization.

One reason is that the infrastructure supporting decarbonization efforts remains clunky and largely ineffective. The detailed operational data needed for companies to build a comprehensive decarbonization strategy is often collected in siloes across different platforms or spreadsheets throughout their organization, making it difficult to combine with the data needed to effectively price carbon, create a Marginal Abatement Cost (MAC) curve of available options and build a decarbonization plan. Integrating the data into the capital planning processes needed for long-term investments proves yet another challenge, with many companies turning to consultants – which are often a costly and static solution.

In carbon-intensive sectors, the stakes for companies to minimize their carbon footprints are even higher, yet the barriers to decarbonization are more prohibitive. Many available solutions on the market lack the complexity required to address heavy emissions, providing only temporary fixes or focusing solely on meeting minimum compliance requirements.

Effective decarbonization solutions are needed for companies to achieve their sustainability pledges. And time is of the essence – because climate change is a feedback loop-based system, a greenhouse gas emission avoided now is more valuable than a larger number of emissions avoided 10 or 20 years from now.

A full-service platform for modeling and executing decarbonization solutions

Enter SINAI, enterprise software that enables deep decarbonization strategies. SINAI’s decarbonization intelligence platform starts by helping major companies in complex industries calculate and analyze their emissions by creating detailed, bottom-up carbon footprint calculations at the process, facility and enterprise level. Where it differentiates itself from other technologies in the carbon accounting space is what comes next: SINAI’s software allows customers to build customized strategies for pricing and reducing carbon emissions across their entire operation, making it a full-service, single source decarbonization solution. Last year, SINAI’s platform tracked over 35 million tons of carbon emissions for customers, while helping them model more than $5 billion of potential capital expenditures for carbon mitigation.

SINAI’s emphasis on actionable, holistic and long-term decarbonization solutions makes their platform invaluable for companies adopting net-zero commitments. Their software is focused on delivering insights to guide the entire journey to decarbonization – moving far beyond low-hanging fruits like LED bulbs and PPAs.

Unlike many of their competitors, SINAI was founded to decarbonize the most emissions-intensive industries and complex supply chains. Many of their customers are in the agriculture, transportation, engineering, manufacturing, and metals and mining industries and have extremely complex emissions tracking needs. Among SINAI’s current customer base are Siemens, Bayer and ArcelorMittal. SINAI’s focus on these industries delivers an outsized impact on global emissions by helping heavy emitters build optimized, actionable roadmaps for the most efficient, timely and cost-effective solutions to transition to more sustainable operations.

Software holds the key

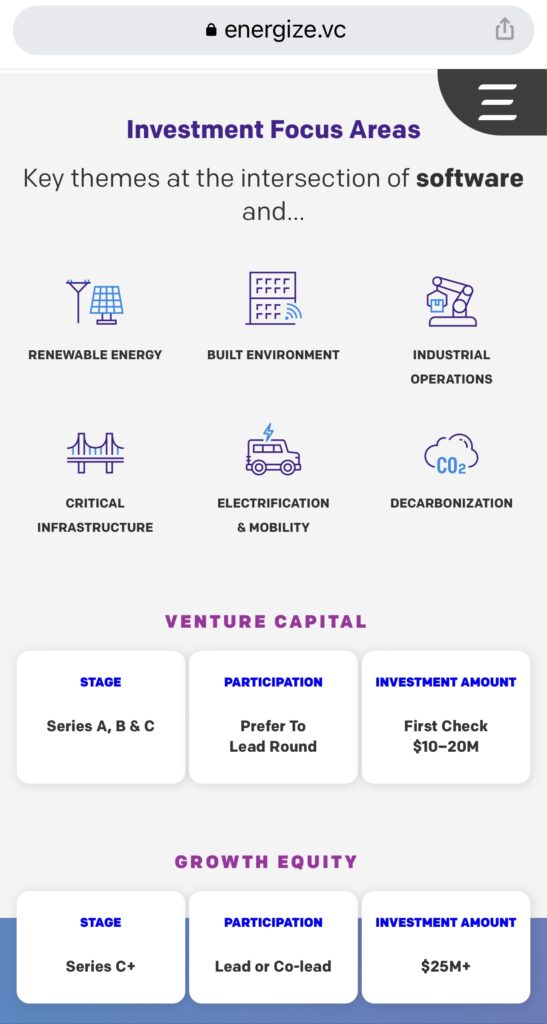

Energize’s team has studied the decarbonization landscape for the last five years and believes SINAI’s best-in-class software makes it a superior product to other solutions currently on the market. As an investor at the intersection of digitization and sustainability, we think software solutions are essential to enabling existing decarbonization technologies to scale quickly and effectively, allowing for widespread adoption and accelerating the energy transition.

SINAI’s software uses detailed environmental and financial data to automate how companies analyze, forecast and model decarbonization risks and opportunities, helping customers unlock capital-efficient emission reduction strategies and find a profitable place in the low-carbon economy.

Unlike consultants offering fixed strategies, SINAI’s software provides customers with bespoke plans with the ability to adapt fluidly to operational and pricing changes. Their platform is designed for flexibility, making it conducive for large companies with cross-functional internal teams looking to work together to achieve their sustainability goals.

A global team enabling large scale decarbonization

SINAI founders Maria Fujihara (CEO) and Alain Rodriguez’s (CTO) combined expertise in sustainability planning and data infrastructure make them well-equipped to pioneer climate-focused software solutions. Maria brings more than 13 years of experience embedding sustainability into her work as an architect and urban planner. Alain draws on his experience from being an early employee at Uber where he was instrumental in building Uber’s Realtime Business Metrics platform.

Headquartered in San Francisco, SINAI has a global customer base with a large presence in Latin America, Japan and the U.S. Their diverse team is passionate about reversing climate change and enabling sustainable business, a key impact theme for Energize.

This funding will help SINAI expand the deep capabilities and user interface (UI) of their decarbonization platform, as well as continue to build a top-tier team of climate and software experts. We look forward to partnering with Maria, Alain and the SINAI team to support global decarbonization.