Climate Tech Fundraising Environment

I don’t fully associate Energize’s focus as “climate tech” but there is certainly overlap in our interests and the theme. Two charts came across my thread this morning that show just how much interest there now is in climate tech/sustainability…

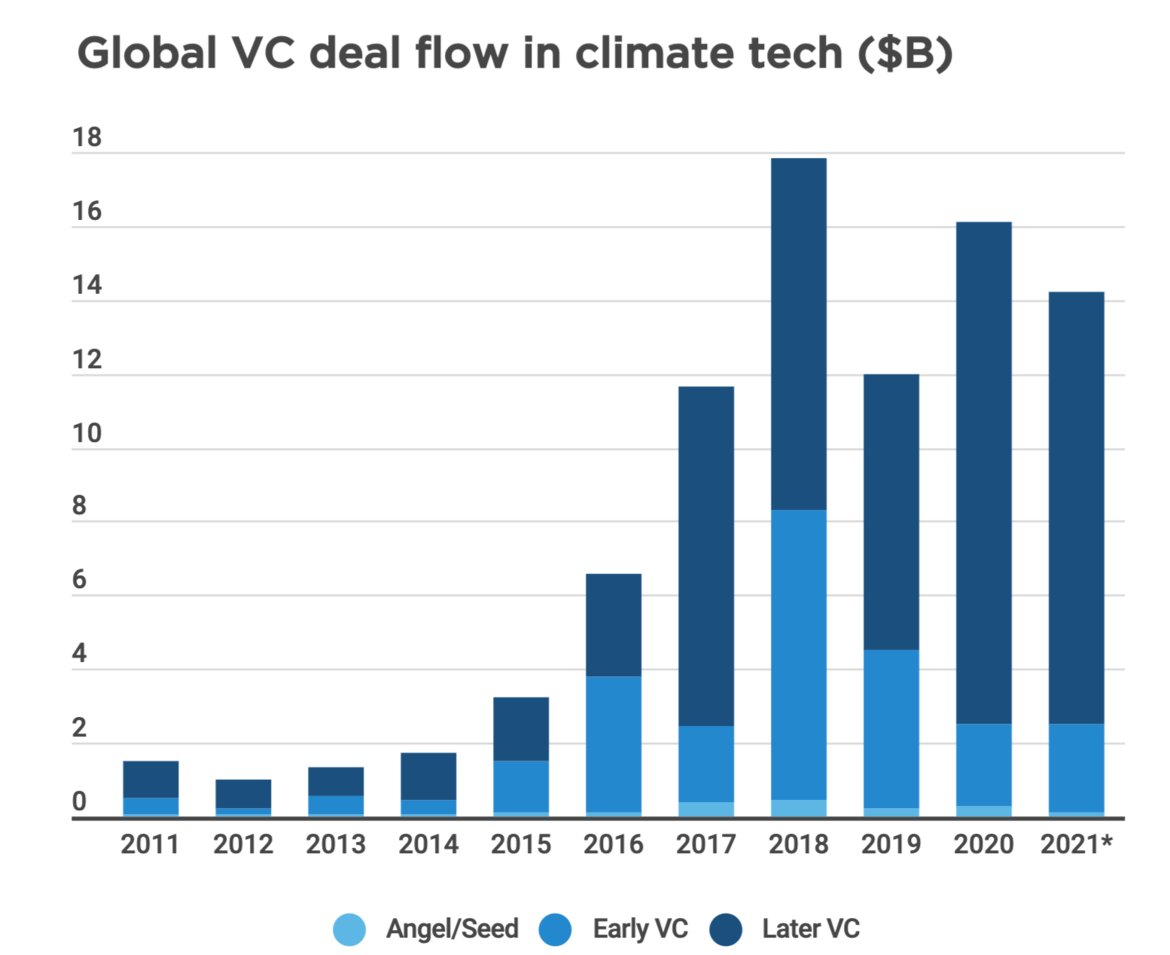

First, is a chart from Sonam Velani that shows that deal flow into climate tech is already at 88% of the 2020 totals and on pace to nearly 2x 2020 figures.

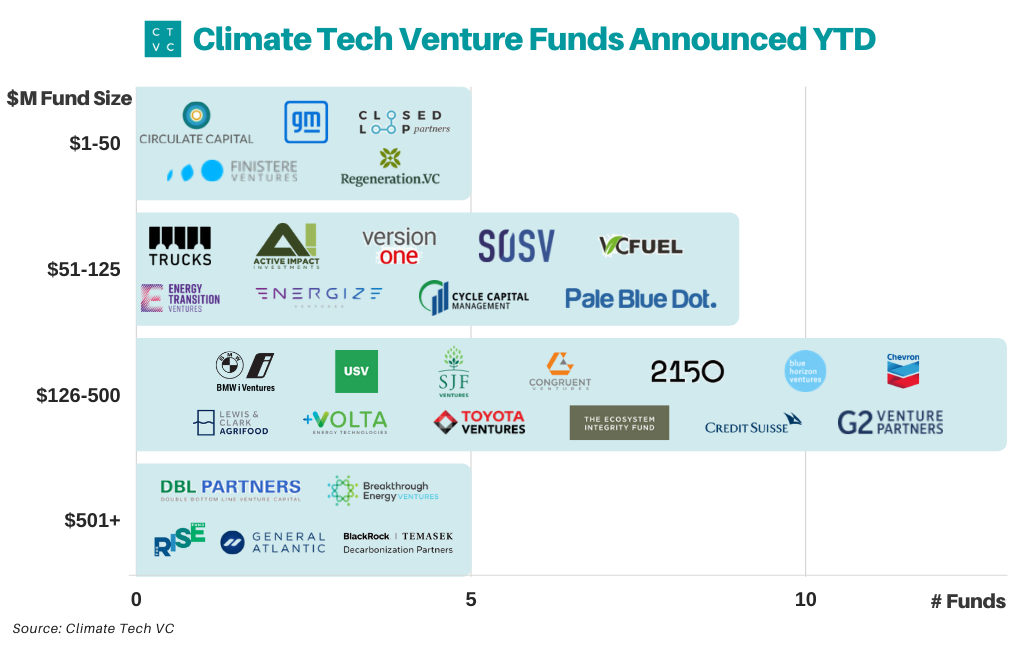

The second is a graphic from Climate Tech VC, a weekly publisher on the theme, that shows the number of funds announced year-to-date. Within this list they also capture Energize’s specific $125M CDPQ co-investment fund. I am expecting many more firms (and funds from existing firms!) to be added to this list by year end.

The supporting data shows that more climate-related funds are being launched in 2021 than the previous 5 years combined. Who is coming to market? We have traditional PE and asset managers like BlackRock, General Atlantic coming to market. We also have traditional VC firms entering climate, like USV and we have a number of corporates (GM, Chevron, BMW, Toyota) launching specific efforts.

I am the most pleased to see the experienced names in the space like G2 Venture Partners, DBL, and Congruent are also raising new capital to accelerate the sustainable transition. There are a lot of nuances to investing in the energy and broader sustainable transition and the newest entrants would benefit from studying these established firms.