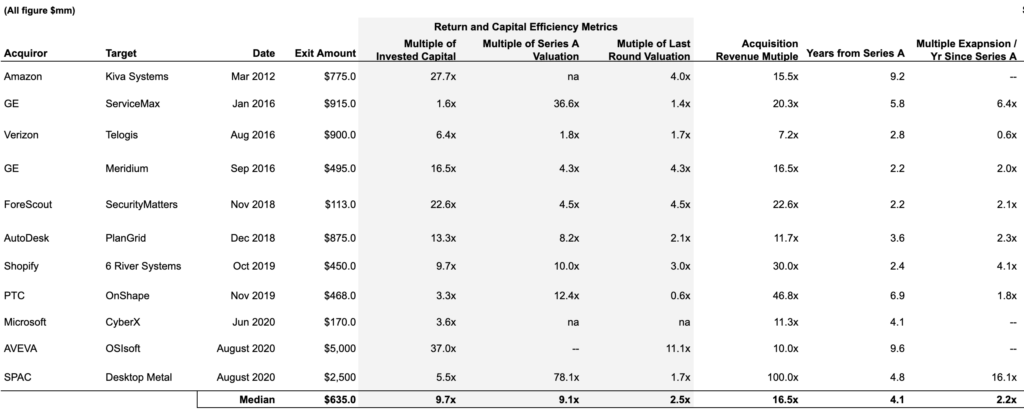

Evaluating the Successful Industrial Technology Exits

The definition of industrial technology is very broad. And the best industrial technologies ultimately get used across a number of manufacturing, energy, real estate, healthcare, logistics and OT industries.

Due to the nebulous nature of this space, the M&A narrative is not well-covered. Last week I asked IndustrialTech twitter to highlight successful exits in our space. Special kudos to Ty Findley for sharing more history on the space. Here is a list, with some data points and takeaways:

You can click on the picture to get a bigger version. And here is access to the Google Doc that contains this file. If you have more information, you want to add, please do. Link to the Google Doc Here: Industrial Tech M&A

Using the median figure, here is the narrative;

1- An industrial technology company raises a $11.8M Series A at a $41M post-money valuation.

2- Over the course of the next 4 years the start-up raises another 2 rounds and raises nearly $50M in new capital for $66M in total capital received prior to an exit.

3- By the time of exit, 4 years after the Series A, the start-up achieves $30M in revenue/bookings for a cash efficiency of 45%.

4- The company exits at $775M, meaning the average multiple is 16.5x Trailing Twelve Month revenue. And the exit price isa 9.7x multiple on total invested capital, an 9.1x return on the Series A, and a 2.5x return on the pre-exit round.

What are some takeaways

The graveyard doesn’t speak and these are the best of the best exits for the space. So recognize that the average deal is far less performant than this outcome!

When upside exits rarely exceed $500M, entry valuations and knowing the true TAM and market dynamics is key. The most rewarding exits from this list are the ones where capital efficiency remains a focus for the management team and little excess capital is invested to try to force the acceleration of a deliberately slow purchasing cycle.

Ty Findley, Santosh Sankar, Chris Stallman, and Julian Counihan all recently contributed to an excellent post on “Why VCs Must Specialize” and I agree with the theme: smarter knowledge of your vertical dynamics drives better evaluation and price awareness so that when a start-up is going adrift, alarm bells are raised to realign for upside success. And to keep valuations within a reasonable range to allow for upside returns.

Finally, the high revenue multiples and potentially abbreviated time to exit for the most successful companies (other than OSIsoft!) shows how acquirors pay premiums for access to the industrial customer, but need to see non-trivial revenue levels (almost $30M+) before paying up.

I hope we can add many more to this list in the coming years.!