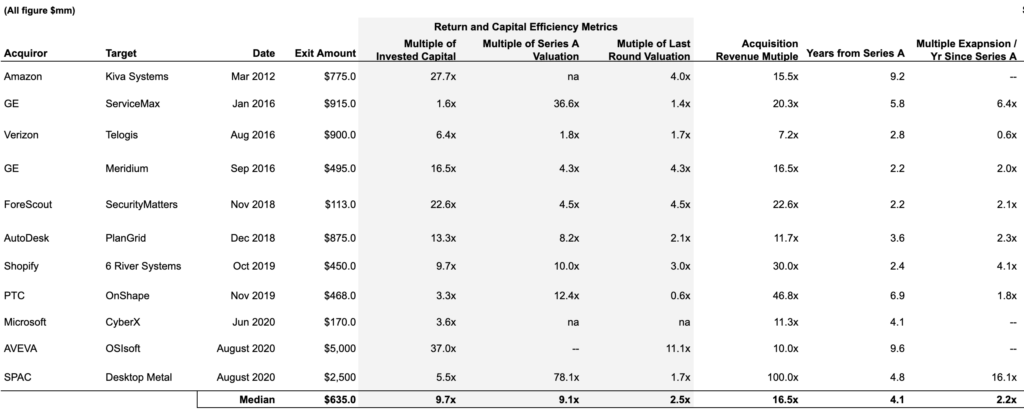

I am calling it: OSIsoft’s acquisition by Schneider Electric controlled AVEVA Software is the industrial technology deal of the year.

While I am sure that there is industrial technology M&A happening as you read this… and there are some great names like ChargePoint and Desktop Metal are in the rumor mill for a SPAC, it will be hard to top the returns profile that OSIsoft generated for their select investor group.

The structure here will cover a brief summary of the company & product, financing history, and why AVEVA is an especially interesting partner.

HISTORY

OSIsoft was founded in 1980 by Dr. J Patrick Kennedy, a legend in the industrial technology space. 40 years ago. Older than the author and many readers of this post. The company’s core product is PI Systems, a data historian. The PI historian is a data capture, relay and management platform purpose-built for the physical operating environment. If you are looking for a product with incredible retention, it is hard to find a “stickier” one in any market. This is why:

Data analysis primarily occurs on high value assets with extended life-spans: 10-40 years. And once a historian platform is selected it usually lasts the life of that asset. AND when the next asset is installed, of course the operations team at the industrial entity is going to select the same historian so that there can be back-end consistency of data management to allow for simpler data analytics. this system perpetuates such that OSI claims to have 95% of their original customers and be extracting data from over 19,000 industrial sites. This embedded product stickiness is why the company has been able to command high prices for their product and generate material profit.

FINANCING HISTORY & EXIT PROFILE

Grade: A+ for founder, A for investors, B for SoftBank

Dr. Kennedy’s cash management at OSIsoft is the talk of legends. He ran the company on its’ own cash flow from the earliest of days.

Investment #1: Summer, 2011

It wasn’t until summer 2011, over 30 years after starting the business, that Dr. Kennedy decided to bring on external capital. At the time, his business was already generating around $200M of revenue and a sizable EBITDA profile. During the raise, he sold 30% of his company to TCV and KPCB’s Green Growth Fund in equal segments.

He executed a capital raise at a $450M valuation (likely for secondary purposes) by selling 30% of his company for $135M. The company was just about to cross the $200M revenue benchmark and was likely already very profitable. As shown below, this ~2x revenue multiple was a great entry point for the investors.

Investment Event #2 PE Growth Event to SoftBank

In May 2017, SoftBank’s Vision Fund came knocking. With the business now generating around $350 in revenue, SoftBank paid a whopping $2.9BN entry valuation, or ~8x revenue . During this event, the earlier TCV and KPCB investors exited at a very handsome return profiles: assuming minor dilution, back of the envelope calculates show the growth equity round executed by the earlier investors produced greater than a 6x return in the 6 years of holding the business.

Today’s Exit: AVEVA acquiring OSIsoft

Metrics released today show that the business is now at $500M in Trailing Twelve Month Revenue. This means that the company is still growing about 10-15% in topline revenue per year, an impressive figure in the industrial technology space for such a sizable profile. That results in a ~10x revenue multiple.

And as suspected, the company has a very healthy 30%+ EBITDA margin.

This exit produces a mammoth return for Dr. Kennedy, who still owned a majority of the company. SoftBank gets to generate an approx. 1.7x return, which is not too shabby for 3 years given the absolute dollars that the Fund was able to invest into OSIsoft.

The FIT with AVEVA

Grade: A-

Aveva is a global leader in industrial software. The company is undergoing a transition from a mostly perpetual sales model to a recurring sales model. While this transition is never easy, Craig Hayman is considered a world-class operator in the space. AVEVA has an embedded $700M software business and the combination of AVEVA and OSIsoft is very powerful as AVEVA already has a few data historians within their technology suite.

In fact, AVEVA now has three historians, each in complementary verticals! This means that AVEVA is now the de-facto historian across of nearly every asset industry. The only true competitors outstanding now would be Bazefield and GE.

AVEVA’s three different historians:

#1 OSIsoft: primarily serving the process industries: oil & gas, chemicals, pharmaceuticals, etc.

#2 (assigned from Schneider Electric) Wonderware: broad application with an emphasis on post-capture analytics

#3 (acquired through M&A), InStep’s eDNA product. eDNA is also an enterprise-based historian primarily used within the utility and power market.

While I suspect AVEVA’s marketing team will likely want to simplify branding, the fact is that each of these entities has strong brand presence within their specialty verticals. And this product stickiness and brand strength should allow AVEVA and OSI to maintain market share and pricing defensibility going forward.

CONCLUSION & TAKEAWAYS

Top marks for investor returns and capital efficiency. Dr. Kennedy walks away with over $2.5BN in proceeds and was very capital efficient along the way. He has the highest capital efficiency marks of any company in our industrial technology data set. (releasing that in a few days)

AVEVA and Schneider Electric win control of a crown jewel in the asset-heavy market. If you believe that data and data management is a requirement for the next generation of industry, then OSIsoft is an invaluable asset and the price is fair and consistent with other elite assets currently in the software market.

The most important subtly to the story is how this is a 40 year success story. In the energy and industrial markets, there are no overnight successes. These customers buy slowly because software gets applied to real, operating assets. Mistakes cannot be made. Aligning a capital table with this reality is key. And if you allow results to compound for 40 years, good things tend to happen!