Back to back funding announcements!!

Energize Ventures goal to capitalize and support the best companies within the sustainability software stack continues as we lead the €30M Series A+ round into Monta.

Monta is the premier digital backbone for the EV charging industry, enabling a simple and seamless control strategy for site owners, fleet operators, and consumers. We are excited to partner with Casper H Rasmussen and Anders M., and the whole team Monta team. Casper’s quote in the article below shows our experience in the space.

Juan Muldoon and Mark Tomasovic have been spearheading our most recent effort into the space with tremendous help from our entire team. This is Energize Ventures fourth investment in the digital infrastructure that enables the new scale of EVs and EV charging, alongside Smartcar, TWAICE, and Sitetracker.

We are fortunate to again invest with CREANDUM and join Pale blue dot in this round.

We have already had a tremendous amount of pick-up, including an article in Techcrunch. I love this quote from Casper, the CEO of Monta:

We were really impressed by how much knowledge Juan Muldoon and the entire Energize Ventures team had about the EV market when we first connected. For Energize, Monta represents their third investment in digital solutions to support the buildout of EV charging infrastructure,” notes Rasmussen. “Compared to our conversations with other prospective investors, the topics were on a different level. We spoke in-depth about the challenges and opportunities with our software approach. To be honest, we had not planned on taking on a new investment, but from the beginning, we could feel that this partnership was a very good match. Even over the last few months, we are confident that our decision to work closely with electrification experts who understand the entire ecosystem is the right choice as we continue to scale

Casper Rasmussen, CEO of Monta

Press release here:

Monta lands 30M EUR in additional financing to accelerate the buildout of EV charging infrastructure

Company will use the funding to open up new markets, create transparency within the electricity market, and digitalize the power grid infrastructure.

Monta, the only all-in-one EV charging management platform, today announced it has closed an additional EUR 30 million as part of a Series A+ round led by Energize Ventures, a leading global investment manager accelerating digital innovation for energy and sustainability, with participation from returning investors Creandum, Pale Blue Dot, byFounders, and Headline. The latest financing brings Monta’s total to EUR 50 million.

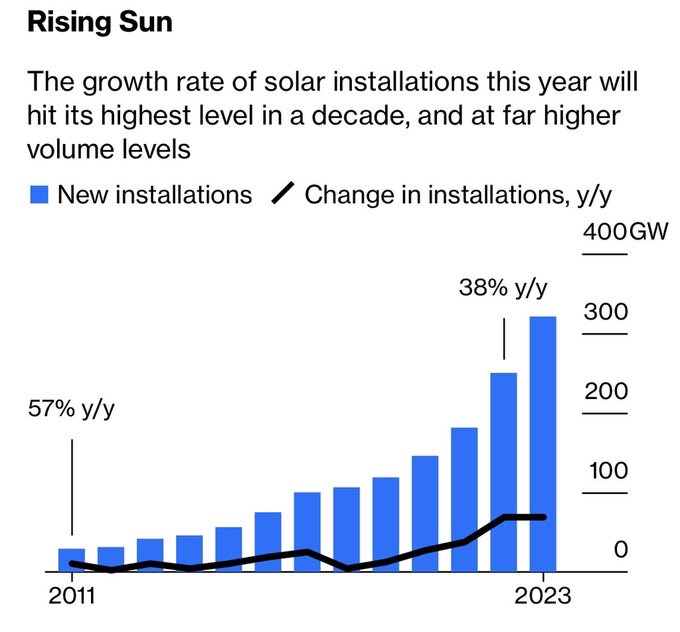

While 2021 European EV sales increased by more than 65% compared to 2020, the lack of EV charging infrastructure is still one of the biggest hurdles to mass adoption. Not only do nearly 3,000 new public charge points need to be built each week for Europe to reach its target of operating one million charge points by 2025, but the customer experience is often hampered by a highly fragmented ecosystem of charge point operators and owners.

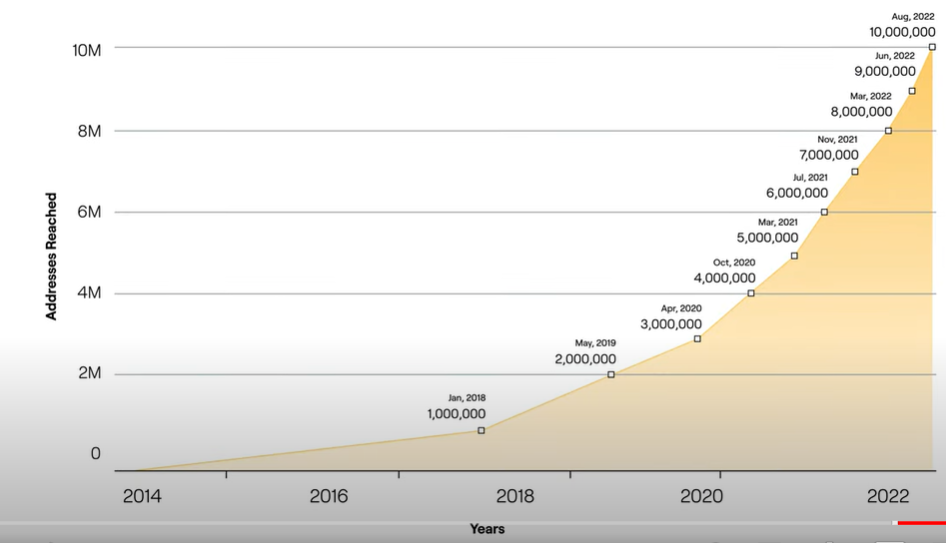

Led by a team of seasoned entrepreneurs with experience managing large software development organizations, Monta is delivering an all-in-one EV charging platform that simplifies and streamlines deployment, use, and management of EV charging infrastructure. Via the Monta platform, charge point owners have full visibility into charge point use, pricing, access, and transactions. For EV drivers, Monta provides reservation, virtual queuing, and payment features under one platform as well as access to public charge points.

“We are aiming to fully digitalize the EV ecosystem to tackle all the immediate challenges within the industry and build toward a more transparent and flexible future. By partnering with hardware OEMs we can deliver new features straight out of the box, like our new feature that allows operators to set a percentage on top of the spot price in order to follow the market fluctuations and automatically offer a fair price for charging, ” says Casper Rasmussen, Monta CEO. “The investment from Energize and our returning investors is a strong vote of confidence in our vision, team, and software as the cornerstone of the mobility infrastructure of the future.”

Monta’s EV charging management platform is used by notable utility, aviation, and transportation industry companies such as Vestas, CPH Airport, and PostNord as well as wholesalers, who are leveraging Monta to upskill installers. Since the company’s latest financing in January 2022, Monta has secured strategic partnerships with hardware manufacturers to launch its Powered by Monta (PBM) program in multiple markets. Key partners include Garo, CTEK, and ABB which each boast a range of charge points in Europe as well as Zaptec, which recently launched Zaptec Park, a co-branded app for its users.

“The market penetration of electric vehicles is climbing sharply as economic, regulatory, and climate levers accelerate EV adoption – and deployment of charging infrastructure has to keep pace. We expect more than 1.6 million public chargers and 20 million private charging stations to be deployed in the U.S. and Europe by 2025,” said Juan Muldoon, Partner at Energize Ventures. “As the market for charge point hardware grows and commoditizes, Monta offers a software solution that enables a consistent, improved charging experience for players throughout the EV charging value chain – from installers to drivers. We’re thrilled to partner with the Monta team as they pave the way for a more scalable and sustainable EV infrastructure.”

Monta will leverage the additional investment to open up new markets including North America, while consolidating its position in Scandinavia, the UK, and Germany, all of which have legislation in place slated to ban new ICE vehicle sales by 2025, 2030, and 2035 respectively. To further support the needs of the EU and the US – which has set a goal for 50% of its car sales to be EVs by 2030 – Monta will ramp up its product innovations and develop critical features to help EV drivers and charge point owners seamlessly navigate the industry.

Looking further ahead, Monta seeks to expand its product development to include grid management services amid challenges as more EVs hit the roads. Ultimately, the company expects to facilitate the sale of excess power back to the grid (V2G), manage interoperability with other zero carbon technologies (V2H, V2X), aid in the creation of local energy markets, and empower end users with ownership over their energy consumption.

“The ability to take advantage of these new opportunities requires changes in information flows among grid devices as well as innovations in communication and coordination tools that increase the observability, predictability, and controllability of the grid. The societal impact and environmental potential of these technologies are massive. Monta is at the forefront of developing the systems needed to monitor and reward this flexibility to create an equitable energy solution for all EV drivers,” said Casper Rasmussen.

The deal is expected to close later this year, subject to regulatory approval.

About Monta

Monta is the operating platform powering the EV ecosystem serving drivers, companies, cities, and the electricity grid with one integrated software solution. We believe that accelerating and democratizing the adoption of EV technology is key to fostering the future we like to imagine. Monta’s mission is to provide the best technology solutions for the entire EV charging cycle. At our core, we provide access, stability and reliability to the mobility transformation. We’re here to make the transition to electric mobility as seamless and exciting as possible with one integrated software built to EV better.

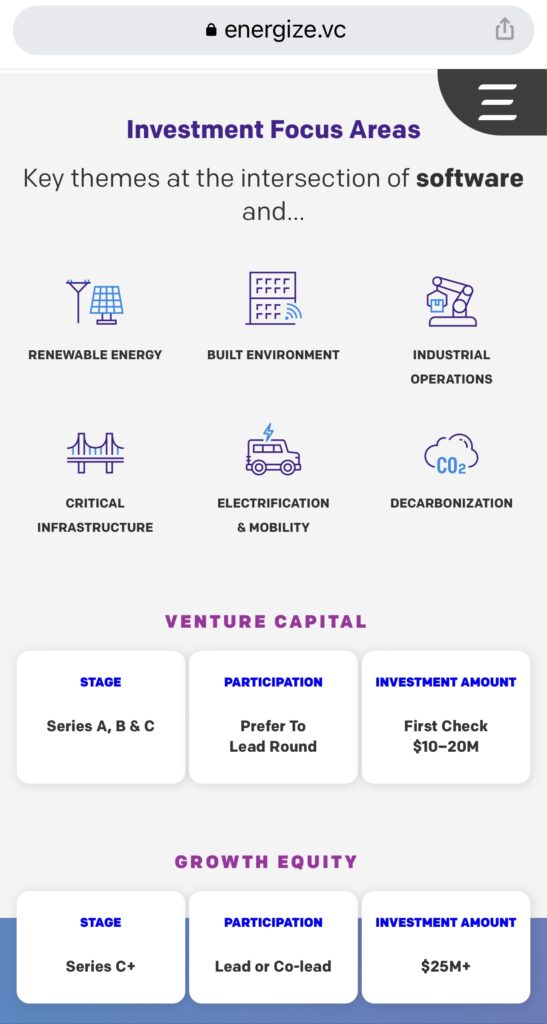

About Energize Ventures

Energize Ventures is a leading global alternative investment manager focused on accelerating digital transformation in energy and sustainability. Founded in 2016, Energize has funded 23 companies to-date and is backed by strategic and institutional LPs including CDPQ, Invenergy, Schneider Electric, General Electric, Caterpillar, and more. With an unmatched depth and breadth of industry and operational expertise, Energize works in partnership with its portfolio companies to realize their full potential from early commercialization to growth scaling and into the public markets. For more information on Energize Ventures, please visit www.energize.vc.

Media Contact