Why BD Partnerships work so well in Energy & Industry

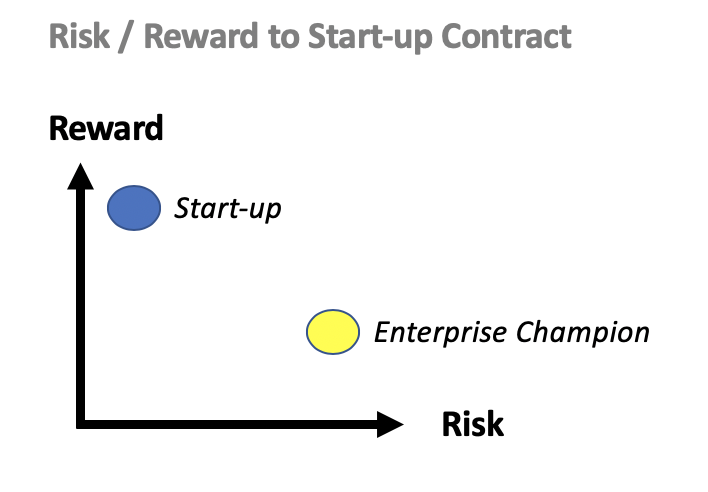

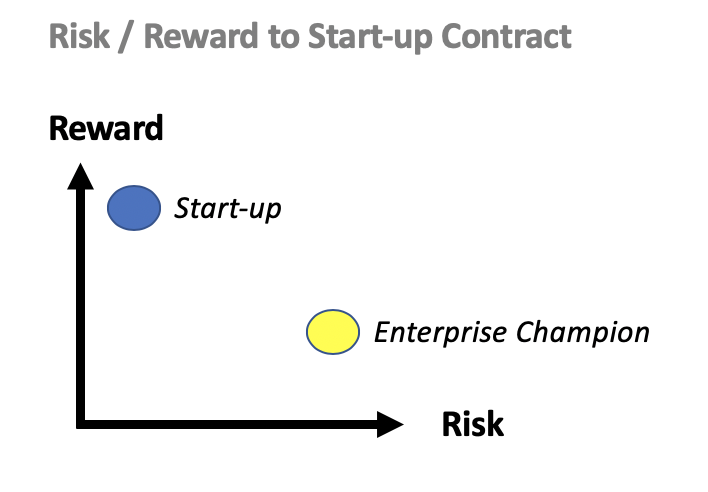

Misaligned incentives make it hard for senior corporate executives to fully lean into championing any new software solution or digital technology. Here is a simple risk/reward matrix for the start-up and enterprise champion:

What is the biggest driver for the delta between the risk/reward of a start-up contract between the two parties? Time.

In the early stage environment the most rewarded moment is the close of the customer sale. In the corporate environment, the winningest moment is potentially years later when the product is implemented and Return on Investment is documented.

Given the big difference in time between the definition of success , employee tenure becomes the 🔑 issue: a Fortune 500 energy, utility or industrial company tenure is between 5-10 years, while a SV startup employee is approx. 2 years.

When an internal champion at at Fortune 500 energy & industrial company is willing to take a bet on a startup, he or she is looking to see if their counter-party will be around for a multi-year engagement. Product implementations on operating assets and systems are complex and require disparate integrations. Unfortunately, most large companies now have horror stories of identifying a start-up only to see the relationship manager … or even the entire company… vanish overnight.

With that scar tissue, most F500 now require channel partners to be the bridge and systems integrator for new technology products being added to their network. Big companies add these partners to buffer against the less stable start-ups. Therefore, I recommend that commercializing startups employ a few tactics to remove the mismatched TIME risk most corporates feel:

- Build BD and channel partnership relationships early

- Develop implementation and customer success teams early to show your you are committed to the long-term relationship

- Feed your channel partner: bringing potential customers accelerates a partnership

- Develop co-branded Go To Marketing stories with clear RoI