Energize – 2022 Year in Review

A link to the post on the site for the full post can be found here). Below is also the text. My two cents:

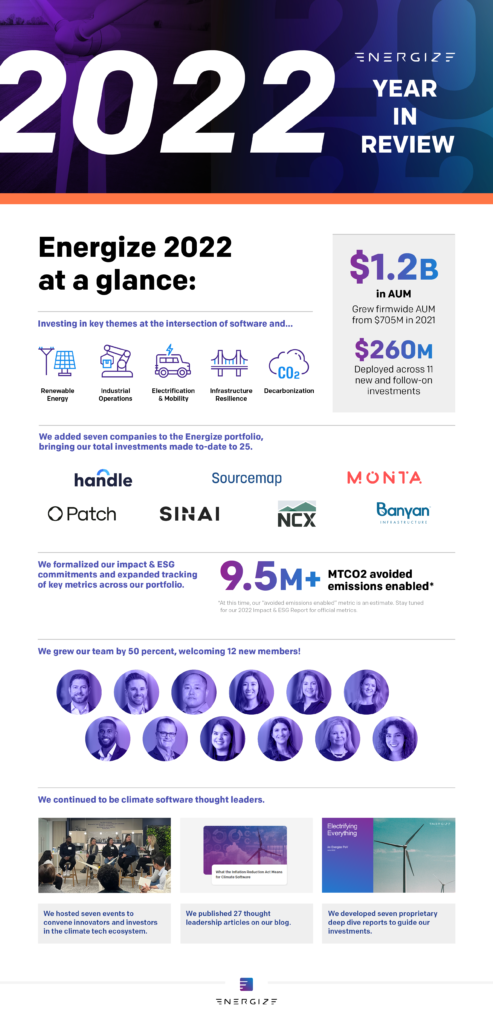

At Energize we have 5 ethos written on the wall. One of those core tenets is “We choose to grow, together”. 2022 was a great year for Energize Ventures and our year-end figures show the early results of the major, deliberate internal investments we are making to better scale and deliver value for our team, our portfolio companies, and our LPs.

We are scaling our team, our value-add methodologies, our approach to impact, and our investment strategies to meet the climate opportunity. Generational firms in climate are being built right now and Energize is motivated to scale with our portfolio and be an enduring investor for decades to come!

Portfolio ⚡️

In 2023, we honed our investment themes at the intersection of software and renewable energy, industrial operations, electrification and mobility, infrastructure resilience, and decarbonization. We grew our climate software portfolio through seven new investments out of our second venture fund:

– $10M Series A in Sourcemap, the enterprise software for end-to-end supply chain visibility

– $50M Series B in NCX, the data-driven forest carbon exchange

– $10M Series A in Handle, the software platform for construction payments and notice management

– $55M Series B in Patch, the platform scaling unified climate action

– $30M Series A+ in Monta, the operating platform powering the EV charging ecosystem

– $22M Series A in SINAI Technologies, the decarbonization intelligence software to measure, analyze, price and reduce emissions

– $25M Series B in Banyan Infrastructure, the sustainable project finance software platform

We continued supporting our portfolio through four follow-on fundings:

– $200M Series D in Aurora Solar, the cloud-based software transforming solar design, sales and delivery

– $30M Series B extension in TWAICE, the predictive battery analytics software platform

– $66M Series D in Sitetracker, the intelligent deployment operations software for sustainable infrastructure

– $50M Series C in Beekeeper, the all-in-one frontline success platform for the deskless workforce

Firm 🏢

We doubled our headcount throughout the year as we doubled down on our efforts to provide our portfolio with operational and commercial expertise. We welcomed 12 new team members with diverse backgrounds – from seasoned software operators to ESG experts and energy industry professionals. Learn more about our team.

In an important milestone for our firm, we published our first Annual Impact & ESG Report. We believe that by more actively managing our impact and prioritizing ESG issues, we strengthen our firm, add value to our portfolio and help scale the next generation of sustainability leaders. We also became members of VentureESG, Responsible Innovation Labs (RIL) and ESG4VC and signatories of the UN PRI. As we progress in this journey, we’re excited to engage with new partners and collaborators to raise the bar together.

What’s Next? 🔮

We’re excited for the enduring growth we’ve seen so far in 2023 for industries like solar and electric mobility – and for the opportunities this growth can yield for our portfolio of climate software companies. On the firm side, we’re continuing to productize our commercial, operational and impact initiatives to accelerate value creation within our portfolio. We also have some exciting events planned throughout 2023 to convene our climate software network!

Finally, our portfolio companies are hiring! Check out our job board to keep up with the latest openings – 176 as of this writing – across our portfolio and work on the front lines of climate action.

This article represents the views of the author and is provided for informational purposes only. It is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Readers should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Information is subject to change based on market or other conditions.