Energy Transition Exit: ChargePoint IPO (SPAC)

A few weeks back I indicated how I hoped that ChargePoint would have a successful market debut. Well, here we are! ChargePoint is about to hit the public market with their Switchback Energy reverse merger. The company released some basic information and is aiming to go public at a $2.4 billion valuation and is raising just over $600M in the process.

I like to keep my “highs” medium, and my “lows” medium and manage the emotional highs and low of being in the entrepreneurship game.

But, let me tell you… this is AWESOME for ChargePoint. The electric vehicle market is clearly the future. California is shutting down non-EV sales in a decade. The UK is doing the same. Other states will follow. EVs are the future and ChargePoint is the largest network. It should be a key part of the energy and mobility transition. And so, this access to the public markets is excellent for a number of reasons. Let me explain:

ALIGNED TO AN UNQUESTIONABLE GROWTH TREND

This picture below shows everything re: top-line revenue

CASH IS KING

ChargePoint will have approximately $683 million in cash, resulting in a total pro forma equity value of approximately $3.0 billion. Cash proceeds raised in the transaction will be used to repay debt, fund operations, support growth and for general corporate purposes. The proceeds will be funded through a combination of Switchback’s approximately $317 million cash in trust, assuming no redemptions by Switchback stockholders, and a $225 million PIPE of common stock valued at $10.00 per share.

And most importantly the company will now have an incredible amount of cash to continue building out their EV network. The demand exists as the number of Electric Vehicle sales continues to grow.

MATURING INVESTOR BASE

The energy transition has been mostly funded by venture capital and the corporate venture capital markets. To see key institutional investors including Baillie Gifford and funds managed by Neuberger Berman Alternatives Advisors joining the ChargePoint financing is VERY important for our market. These are long-term shareholders that are expected to be on the cap table for the build-out duration.

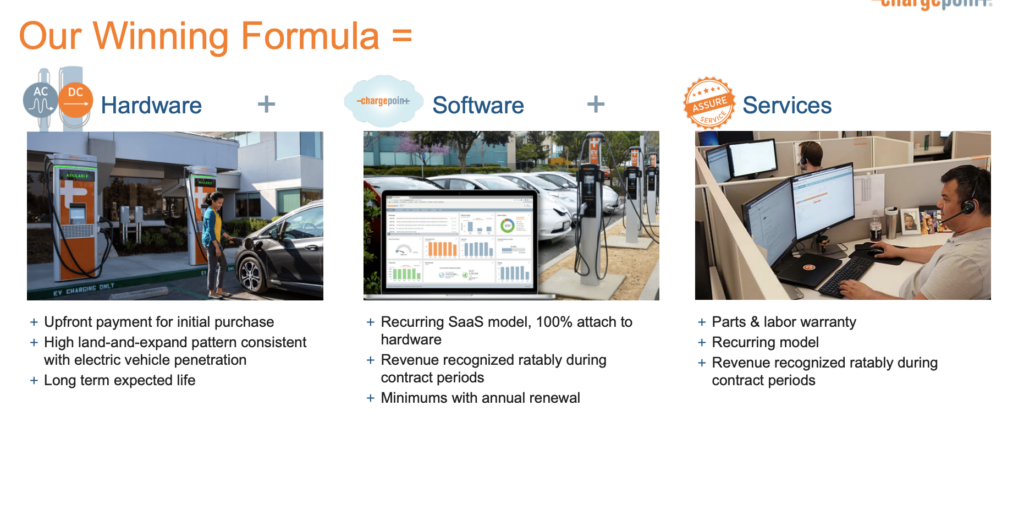

PRODUCT SUITE WILL EXPAND

With the infrastructure layer being built out, the application layer and software layer will become increasingly important. In the ChargePoint announcements, the company emphasized building out of software solutions, network management solutions and payment solutions. This software layer, including Vehicle 2 Grid and grid management techniques, will be very exciting. And main area where venture capital will fund voraciously.

FINANCING METRICS

Ultimately these are going to be a bit hard to swallow. This was 12 years from the Series A and at one point the company had raised ~$700M in equity to achieve a ~$1BN valuation. Not a lot of value appreciation. This is what “being early is like being wrong” may look like for an investor base. But the company, like the EV adoption market, has made great progress over the past 18 months and consumer demand has pulled ChargePoint towards greater scale. Big kudos to Michael Hughes, a relatively new Chief Revenue Officer there, for getting a lot accomplished.

VALUATIONS

ChargePoint will have around $135M of revenue in 2020, growing to 200M next year. And is targeting to grow to $2 billion of revenue by 2026. This high growth revenue opportunity is the growth the public markets are looking for right now in a low interest rate environment.

This means that ChargePoint’s current $2.4 billion enterprise valuation is 17x current year’s revenue, 12x 2021E revenue and ~1x 2026 estimated revenues. Yes yes, these are frothy. But in a low interest rate environment, the market is searching for 10-year growth opportunities and ChargePoint presents that unquestionable opportunity.

I have updated the Energy Transition M&A file here