LP Commitment & Interest Based on Firm Age & Size

Yesterday I wrote about the return profiles for emerging managers. That Pitchbook data showed how emerging, specialist managers outperformed the market. This morning one of my teammates shared an article about how LPs are thinking about Fund allocations in 2022.

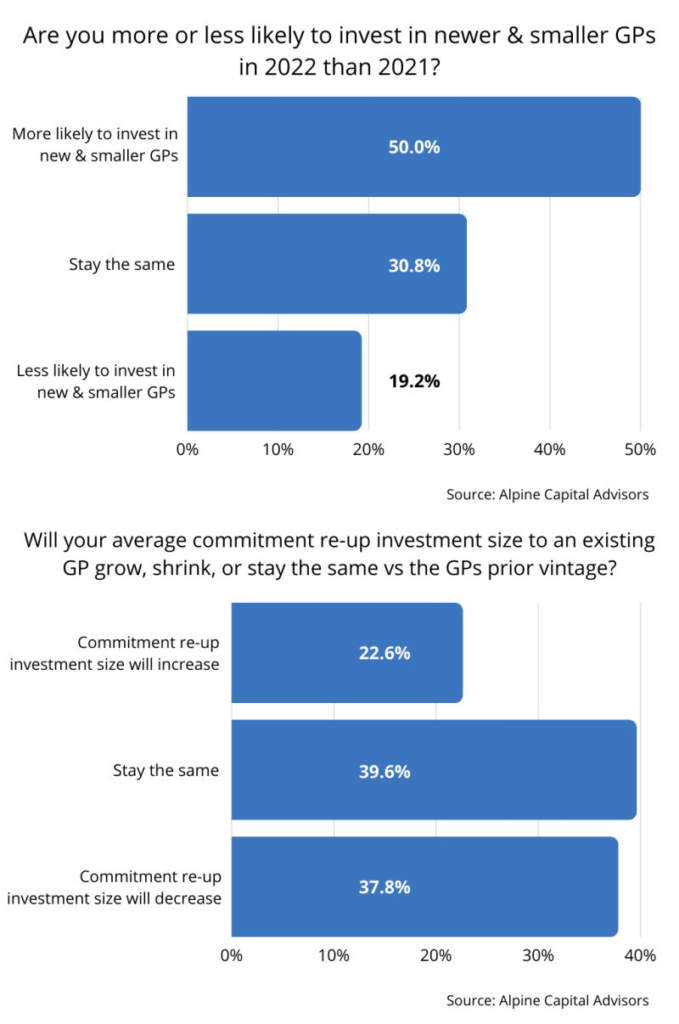

This data, shown below, indicates that LPs are looking to allocate more capital to emerging managers. Given that most investment firms in the broader energy and sustainability markets are on a newer vintage fund, this likely means more capital coming to the sustainability and technology markets. Energize is seeing an increasing number of excellent investment opportunities, so I firmly believe this capital can be deployed successfully over the coming years.