Hungry Honeywell

The purpose for this series is to highlight the traditional industrial technology firms that are re-accelerating growth through M&A. I will be covering 3 firms, and there may be an encore. Earlier this month I covered the first of the firms, Rockwell Automation. This week I am covering… Honeywell.

Honeywell is a Charlotte, North Carolina based industrial conglomerate with over 113,000 employees across the globe. The company has $37 billion in annual sales, 33%% gross margins, and approximately $8-9BN in EBITDA. Those financials earn the firm a market cap of $113 billion dollars and enterprise value near $120 billion. This means Honeywell trades at 3x revenue, and 14x EBITDA. Here is their 2019 Investor Presentation.

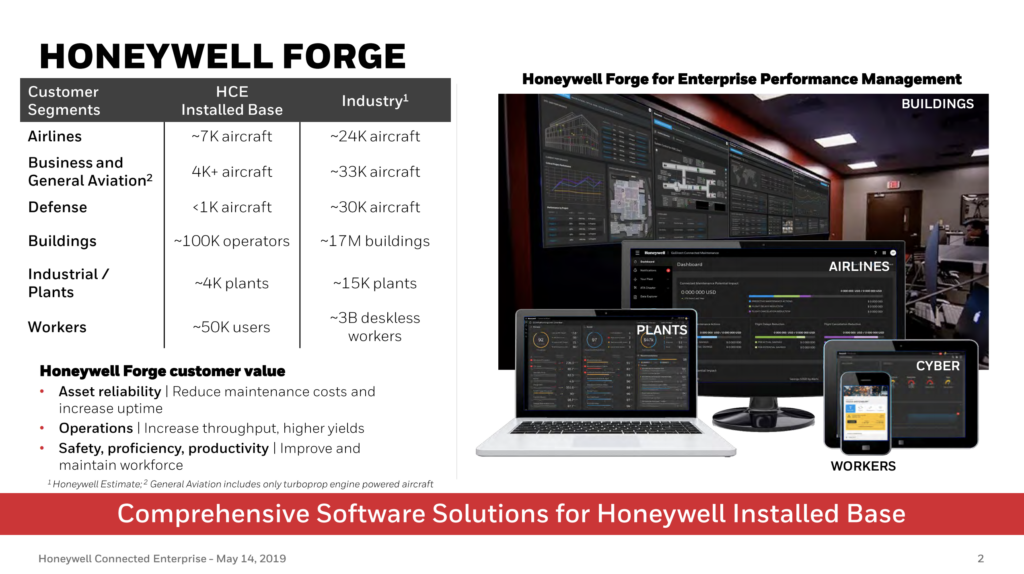

I really enjoyed researching Honeywell for this process. Honeywell is on a journey to become a software industrial. Quarterly reports, annual reports, press releases, hires and new product lines all point to an incredible investment underway to help Honeywell change their business model. Switching a primarily hardware firm to embrace a software product and distribution model is a herculean task. But, everyone remembers Hercules… so it only takes one. Here is why I think Honeywell can pull this off: the standing up of an independent Honeywell Connected Enterprise (“HCE”), and the launch of the core product Honeywell Forge, the Enterprise Performance Management suite. Given how intentional Honeywell management is in noting that their growth and M&A will come from within HCE, I will be focusing my M&A / inorganic growth review therein.

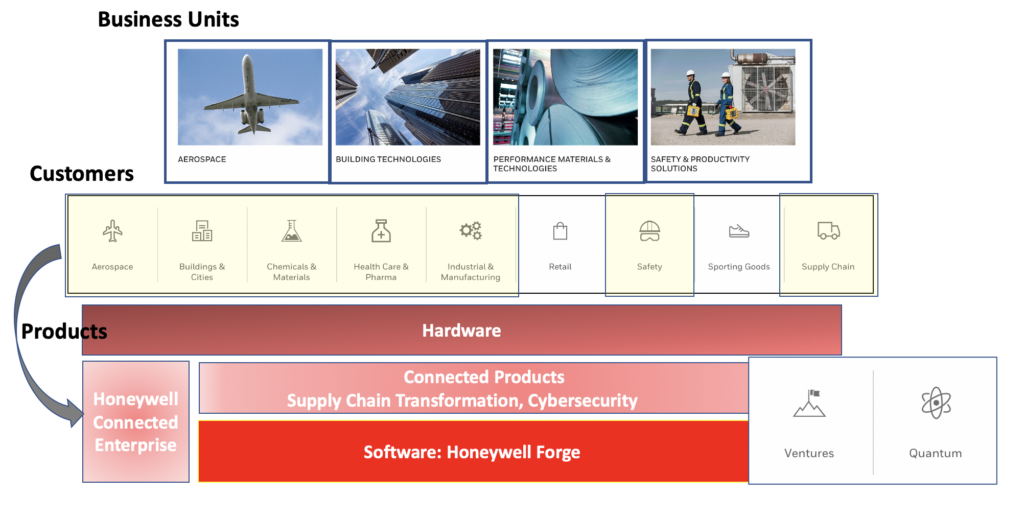

This one image is the best way I can capture the current state of the organization:

Aligned and Simplified Business Units: 4/5

Clear M&A Goals, with Recent Examples: 4/5

Clear Minority Investment Goals, with Recent Examples: 5/5

Aligned & Simplified Business Units

Honeywell has 4 business units with a diverse set of customer types that fit within the groups. The four divisions are:

- Aerospace

- Building technologies

- Performance Materials & Technologies

- Safety & Productivity Solutions

The firm also has a cross-functional division, Honeywell Connected Enterprise, that delivers digital products and services across the entire organization.

As seen in the first graphic, the Honeywell Connected Enterprise is comprised of HW/SW products, and exclusively software products. At the core of HCE and the software effort is Honeywell Forge. Many industrial firms look to create a central platform to aggregate technology solutions. Honeywell is taking a different approach with Forge: it is a domain-specific, low-code cloud operating model built to be system and OEM agnostic. The cloud suite simplifies data extraction from assets, people and process and uses a combination of proprietary AI/ML mechanisms and partner applications to solve business-specific problems. In the past, industrial firms have tried to take a “one platform fits all” approach. HCE, however, is accepting domain-specificity and the power of the Subject Matter Expert. And accordingly is delivering a model and supporting applications tailored to the business outcome.

While this focus on creating low-code, cloud, and domain specific industrial models may seem obvious, the fact is that each of those items (low code, cloud, AI/ML) are all “why now” events that simply couldn’t be been combined in an economic fashion even a few years ago. And this conviction, it appears, is where a lot of M&A growth will be focused.

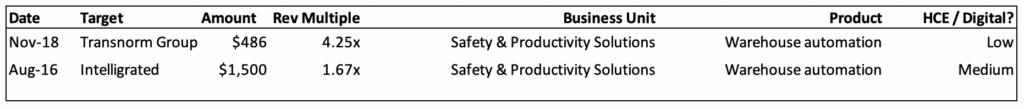

Clear & Consistent M&A Goals, with Recent Examples

Over the past decade, Honeywell has acquired 25+ companies. Most of these acquisitions are small bolt-ons or have little publicly information. However, over the past 4 years the acquisitions began to grow in scale and towards the software narrative. My personal favorite of the recent acquisitions is Intelligrated. Honeywell acquired Intelligrated for $1.5 billion and gained supply chain automation solutions that include cloud-connected mobile worker applications, high-performance data collection hardware, and other technologies to improve worker productivity. With the growth of e-commerce, warehouse and logistics software is a clear growth market.

Here are the recent notable M&A events at Honeywell.

Interestingly, though, it appears that the future M&A strategy is different than the past. Here is a clip, with quotes from the CFO, Greg Lewis, from 3 months ago!

Later on in the article, the CFO highlights nearly $1 billion in cost savings and $3 billion in new financing structures to bolster Honeywell’s cash balance to $15 billion. Combine that cash balance with a recently hired world-class Head of M&A, Emily McNeal, and Honeywell is going to be hunting.

So where will they be hunting?

Supporting Data 1: In the past 12 months, Honeywell has built out a M&A team specific to HCE. And you can bet their Key Performance Indicators are to acquire technology & revenue… at fair multiples.

Supporting Data 2: Per the “Why Now for Forge” from above, these two pages (seen below) are starting to show up in nearly every shareholder presentation:

Come hell or high water, Honeywell is going to invest into digital solutions to enable HCE and Forge. Honeywell HCE execs are starting to see that their sales execs can sell software into existing customers. And Honeywell needs those early wins to gain confidence to make M&A moves. Based on these pages above, it looks like they are particularly focused on horizontal software applications that address a combination of the below industries:

- energy, refining, petrochemicals

- Manufacturing and industrials

- Airlines, business jets, defense

Clear & Consistent Channel Partner, Minority Investment Goals

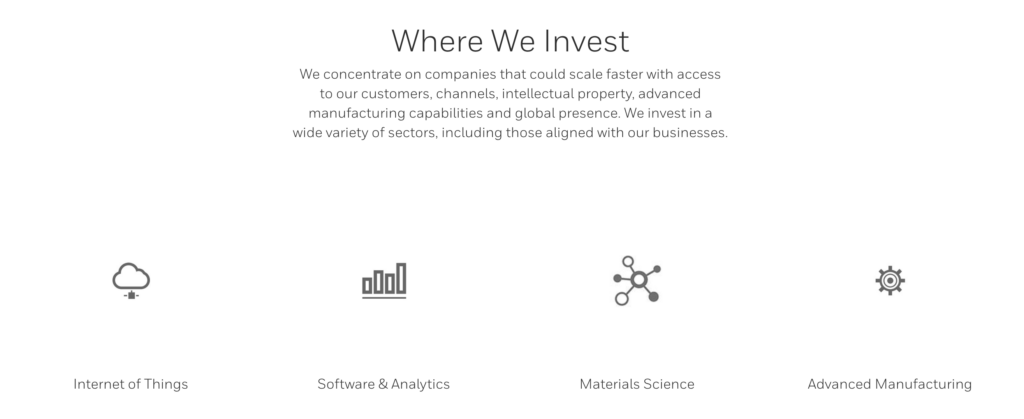

Honeywell has built up a sophisticated Ventures effort. This effort is led by Murray Grainger. As the screenshot below shows, Honeywell has made it crystal clear in what technologies they want to make minority investments. This clarity is very helpful for the market. And if you want to see if

While the company does not specifically say ‘software’, 12 of their 13 listed investments are software-dependent investments. And these software platforms are primarily horizon applications and serve a number of the asset-heavy industries through the core program. As shown in the initial diagram, Honeywell also has a quantum computing effort and a few of their minority investments have exposure to those opportunities. There is also a similar exposure to Industrial Internet of Things communications networks, and managing the complexity of those sites.

AirMap: Digital airspace and automation company serving the drone economy.

Zapata Computing: Developer of quantum algorithms designed to commercialize quantum computing technologies.

Foghorn: Developer of an edge intelligence software designed to deliver the power of real-time industrial-grade analytics to resource-constrained edge devices.

Theatro: Developer of a wearable communication device designed to revolutionize in-store communication and hourly worker productivity.

These types of deals over the past 24 months are more consistent with the future M&A goals that enable Forge. A majority of these companies are digital first with cross-industry customers.

In Summary

Honeywell is biased towards action and growth around their software strategy. They have set-up Honeywell Connected Enterprise to enable the digitization of the connected products and quickly ramp up their software offering via existing sales channels. Honeywell is not trying to hide their ambitions: the goal is to build low code, cloud-enabled and domain-specific industrial operating models that embeds proprietary and third party applications.

With HCE and Forge as a software pillar, Honeywell is looking to grow their existing $1.5 billion software & connected products business by 20% a year. This growth means that HCE is looking to add $300M a year in digital revenues. While I suspect there are substantial organic tailwinds from existing clients seeking a digital relationship, I bet that Honeywell will seek to add similar amounts ($200M+) to topline digital revenues via M&A. any start-ups should be keen to get involved in the HCE and Forge application network.