Industrial Tech: do more with more

In yesterday’s post I covered one of the subtle highlights of revenue diversification: The New York, New York Rule to Revenue. Quite simply, the companies that can get lean and profitable on low margin industries can be very successful when tweaking their product as the company scales into higher margin verticals. And there is a second, hidden benefit to revenue diversification.

Hidden Benefit 2: Do More With More

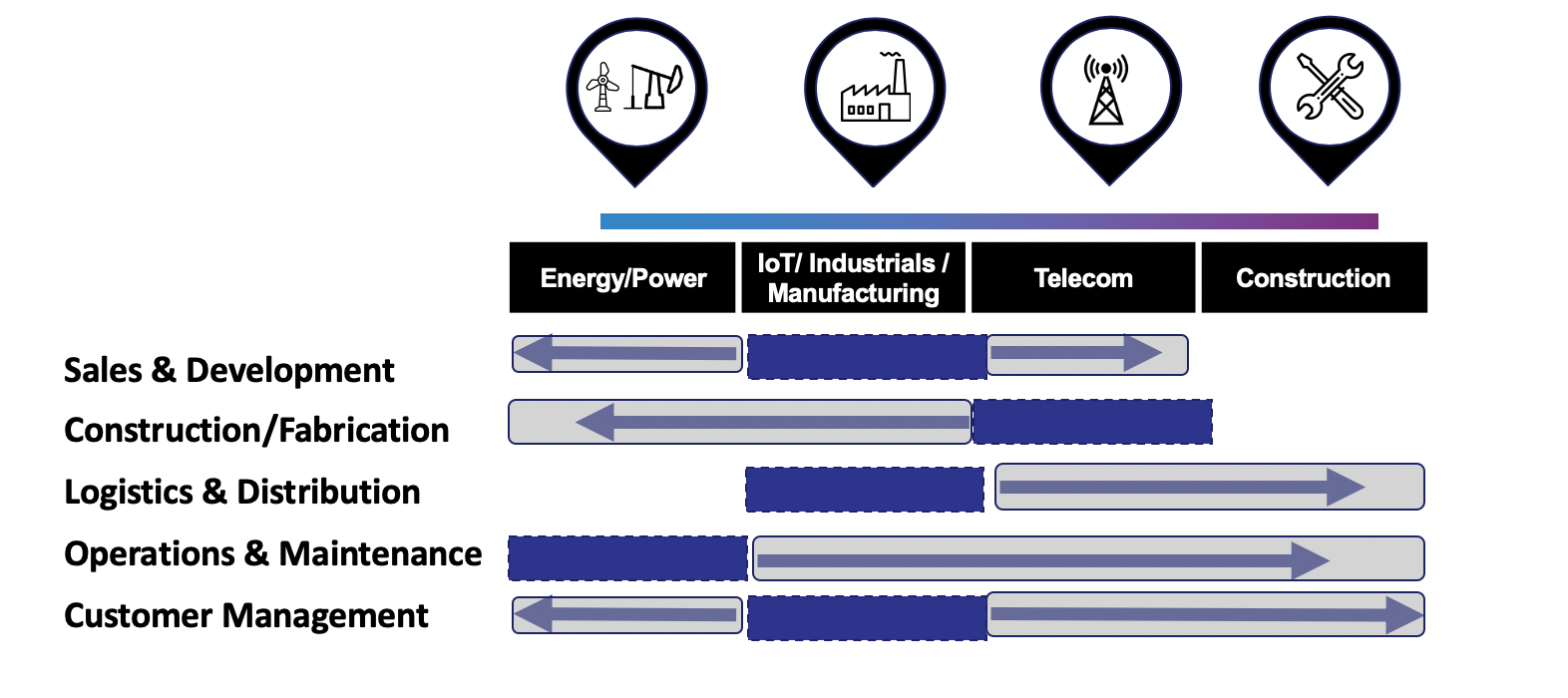

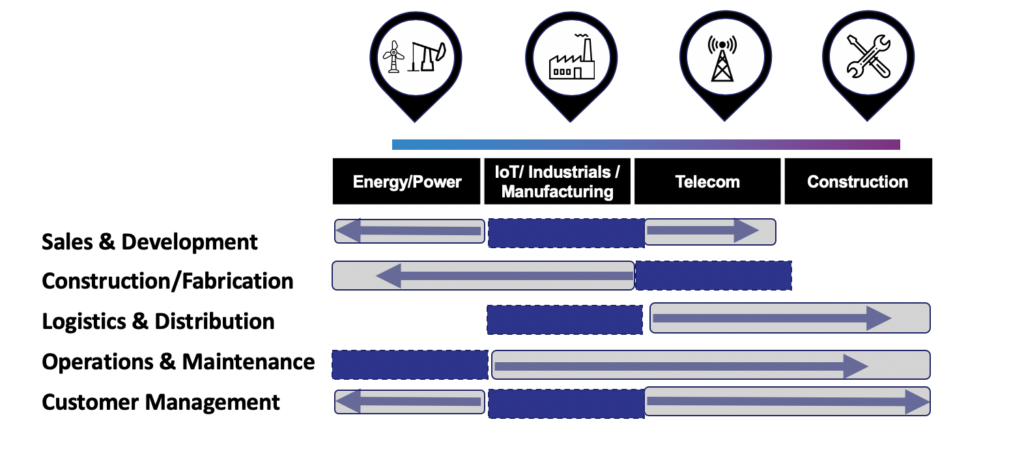

The verticals within energy and industrials behave more similarly than appears on the surface. Generally each of these analog and hard-asset industries has the following stages to their process:

Sales & Development -> Construction/Fabrication -> Distribution -> Operations & Maintenance -> Customer Management

At Energize I am fortunate to see where startups focus their efforts, and a common belief is to focus on one vertical and one point in this ecosystem: O&M analytics for wind; distribution logistics for a commodity; sales management for hardware OEM…

While I applaud focus, in this space, making a product cross-industry ready as soon as possible is a huge positive. Energize has seen the greatest success for this expansion when the core product has a data advantage. The expansion can look like this:

Why?

- Improving your product & data model with cross-industry use cases: the best start-ups are looking to hoover up as many data sources as possible to improve the underlying analytics & model. The decisions in critical infrastructure, are concave: the predictions need to be correct and a bad prediction can be catastrophic. (Thanks to Ash Fontana for the concave/convex framework) Great entrepreneurs realize this early on and seek multiple inputs to their data product. For example, inspection algorithms trained to work for a transmission line tend to learn from models that evaluate within oil & gas pipelines, or when a SME is inspecting a railroad track. And since these are mission critical assets, decisions and predictions need to be faultless and subject matter experts pay premiums for proven models.

- Early horizontal expansion forces and entrepreneurs to build scalable distribution and implementation. The best teams use this moment to build distribution (intra-customer and cross-customer) within the product at this stage.

- Accelerate new revenue: leverage the fact that the sales and purchase patterns are surprising similar across these hard asset industries. And the software needs, specifically the data products, have incredible overlap. Serving multiple industries might require some change to the marketing and value-proposition language but the models are quite similar.

- Critical infrastructure customers are looking for validation: your ability to engage and retain a high-touch customer. Your ability to show different industry logos at an enduring level drives confidence in your staying power as a firm and your ability to be a good partner throughout the lengthy sales implementation timeline. This is the why BD and channel partners work so well in these industries.

As shown above, by deliberately seeking cross-industry adoption, a startup can drive product enhancements and force a more traditional approach to software distribution. More is more.