Performance and Fundraising Progress of Emerging Managers

I saw an analysis recently on performance details around “Emerging Managers”. Emerging managers are investment firms, like Energize, that are in the first 3-4 flagship funds, and within 10 years of founding. Most of the below data came from Pitchbook, a data platform owned by Morningstar. The key takeaways are below:

• Contrary to conventional wisdom, there is little differentiation in step-ups between larger emerging manager funds ($500 million+) and smaller funds.

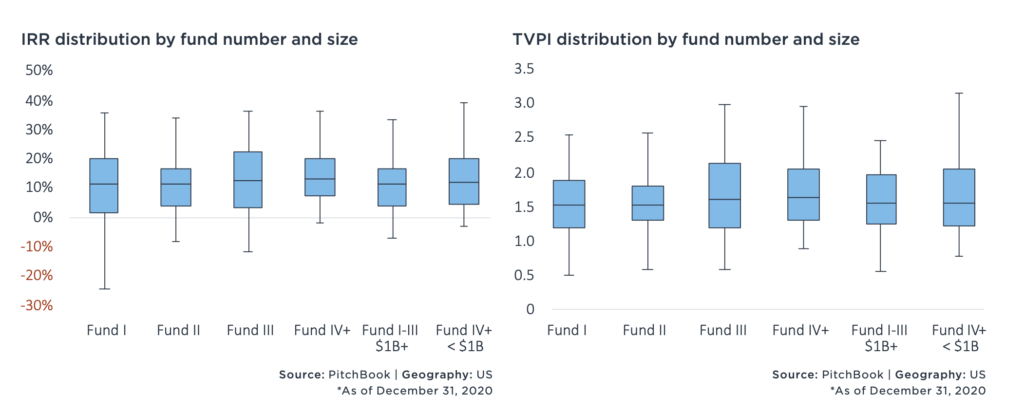

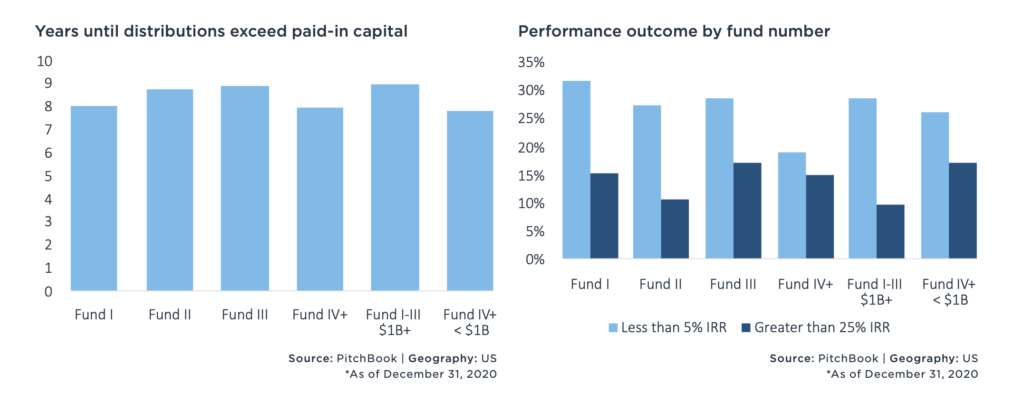

• Also contrary to conventional wisdom, emerging managers do not consistently outperform established managers, although there are some nuances. First funds exhibit the most performance variation, while second funds underperform and third funds slightly outperform. However, these trends vary significantly by vintage. Very large emerging manager funds ($1 billion+) perform in a tighter band, with less outperformance. Additionally, first-time funds return capital more quickly than second and third funds.

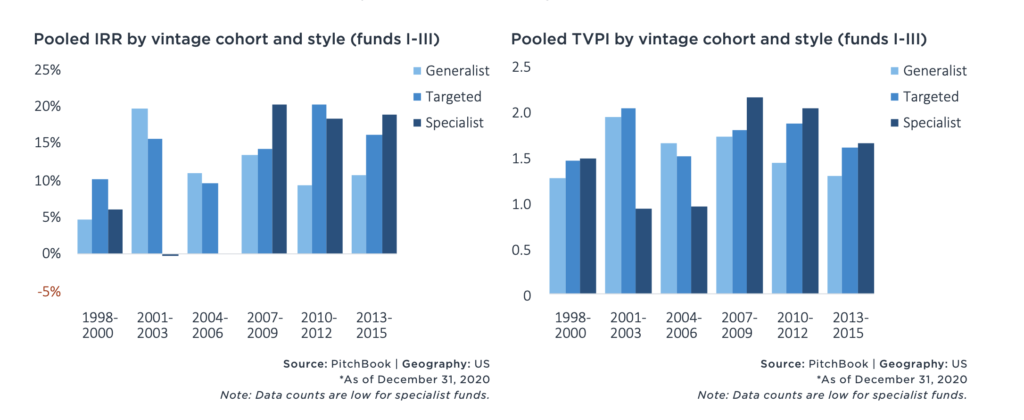

• Since the global financial crisis (GFC), specialist emerging managers have outperformed generalists. (This point is a pillar for Energize – industry expertise and access is a big driver of our returns)

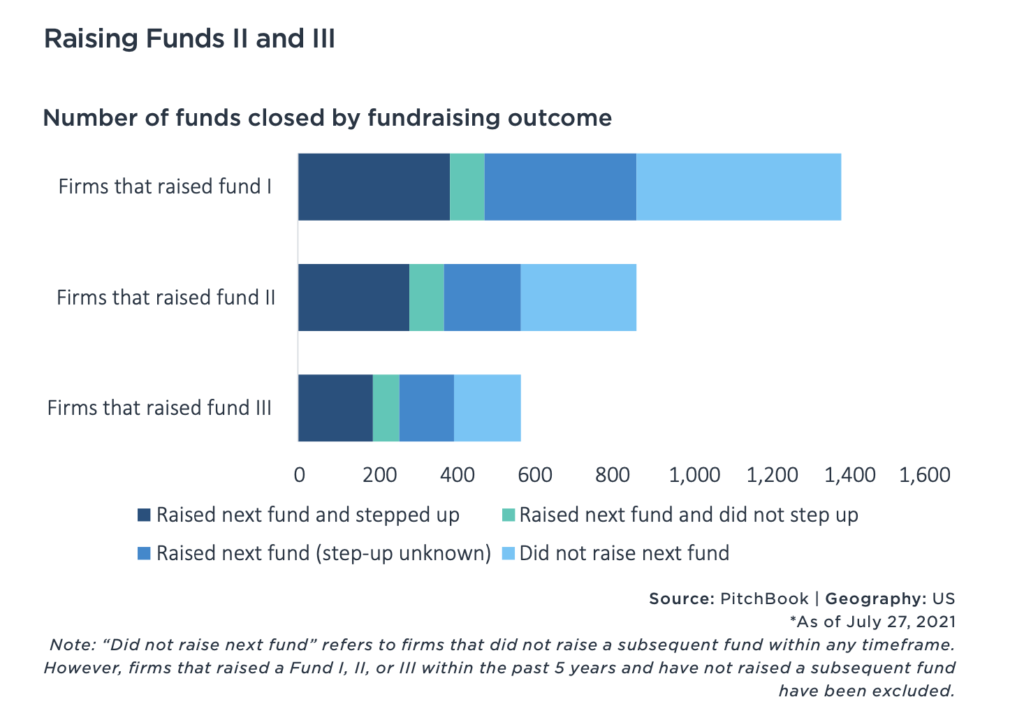

• At each stage of progressing from Fund I to II, III, and IV, about one-third of managers fail to raise the subsequent fund. The success rate for subsequent fundraises increases modestly as fund number increases.

• Because managers often begin fundraising well before they have realizations from their previous fund, LPs primarily look for persistent strategy execution when deciding whether to reup with an emerging manager. Failure to raise a subsequent fund can often be traced to early portfolio losses or key personnel turnover. (Do what you told your LPs would do!)