… this time is different

In June 2007 John Doerr took stage for a Ted talk and got emotional talking about climate change. The battle was on and cleantech 1.0 momentum was in early innings.

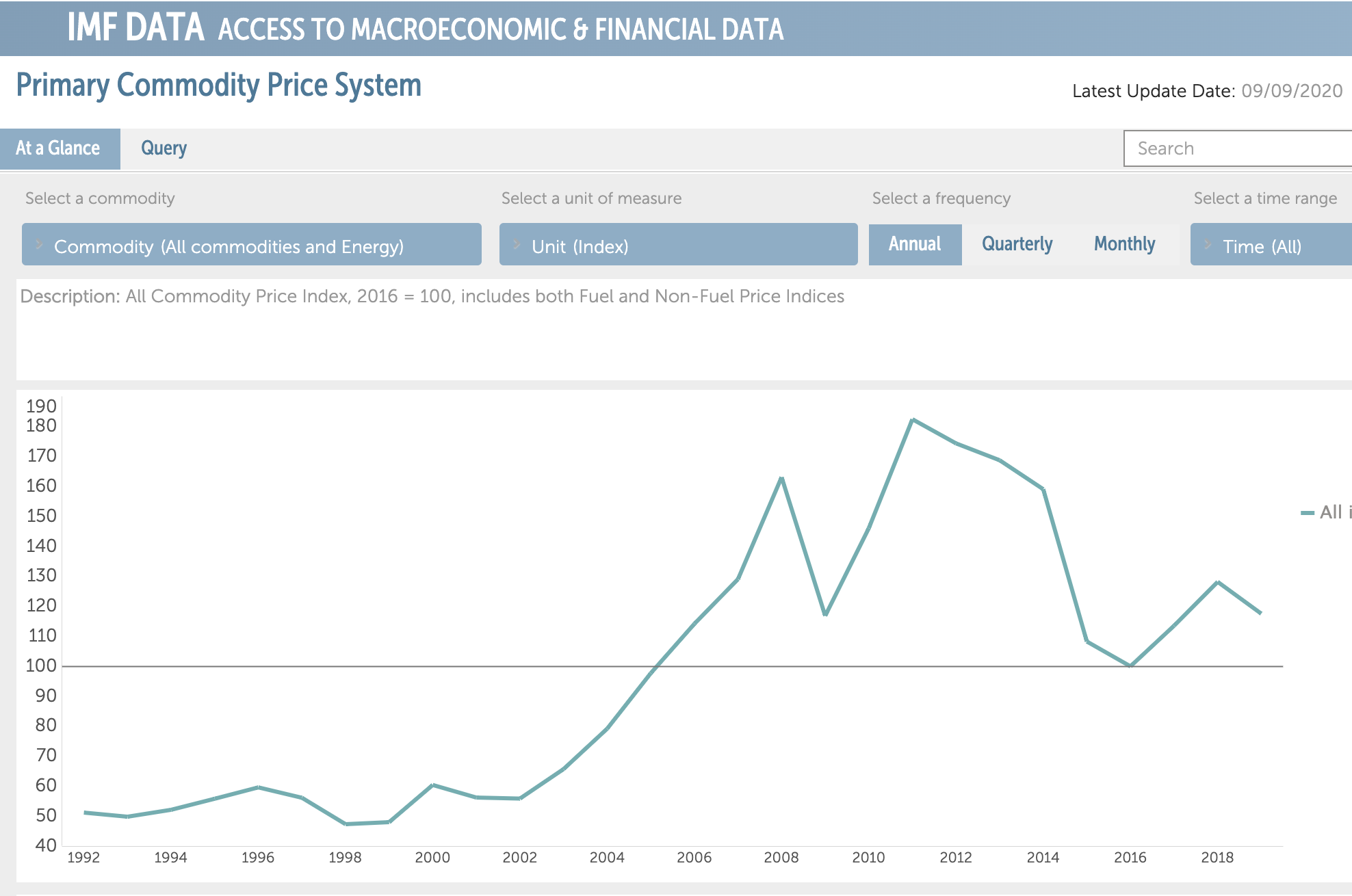

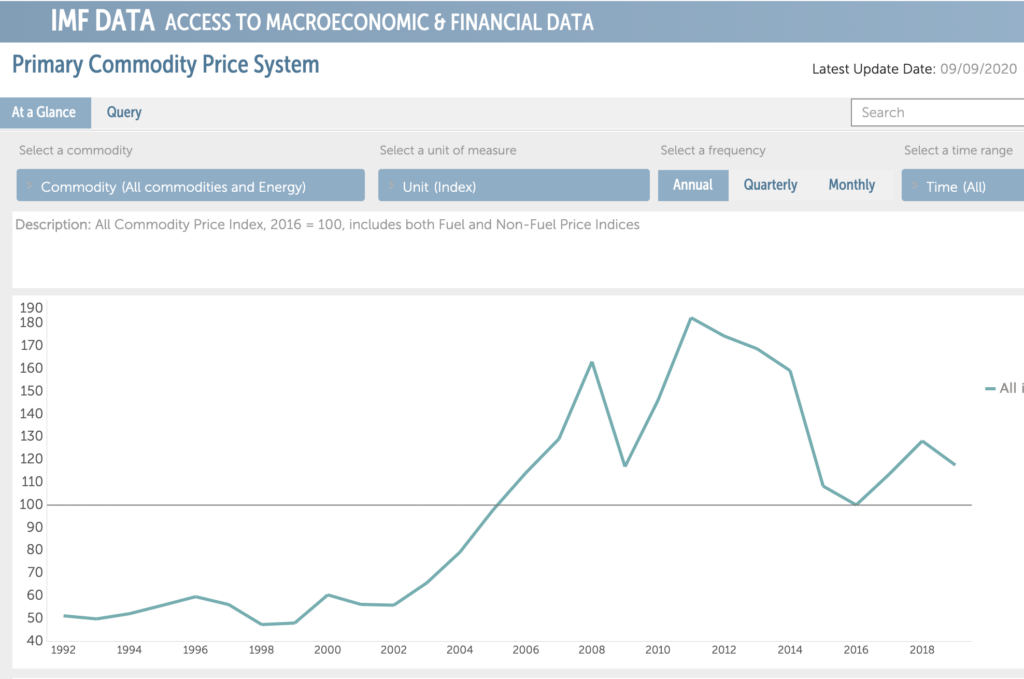

I now look back to speeches like this one, press highlights, old investment memorandums, etc. and almost EVERY message was based on price. So many investments were a hop/skip/jump away to being able to compete on price with traditional energy sources. The reason for this messaging was because commodity prices were going UP and meeting renewable alternatives at the higher cost tiers. Here is an Index chart from the IMF on global commodity prices over the past few decades.

As you can see here, cleantech 1.0 was a false front because new energy investors and operators were gaining confidence in a battle that was taking place outside of normal bounds. Therefore, when energy prices fell in the early 2010s, the near-term goalposts for many capital intensive renewable companies moved further into the distance…. bankrupting most. But these cleantech 1.0 investments did ultimately help.

Since the peak of late 2000s and early 2010s, commodity prices have plummeted and (driven by those early investments) renewable prices have chased them down even faster.

This framework us one I use to evaluate an industry’s readiness for change:

Is a new technology viable due to temporarily high incumbent costs or is the new technology sufficiently developed to chase the incumbent solution WAY down the cost curve? (to use a sports analogy: are we competing on a level playing field, or is our opponent handicapped? Don’t celebrate too much if the conditions are non-standard to your benefit!)

What makes now an exciting time for renewables is that nobody is really talking about price competition with traditional fuels anymore. We are way down the price curve: fuel prices are low and renewables are OK competing at those levels. And if there is a discussion around price, it is usually between different types of renewables.

This time is (probably) different.