Volta Charging Powers On

Below is a press release that Energize wrote about today’s Volta Charging Series D.

While today’s announcement is a mini celebration along Volta’s EV journey… I have two items to elevate:

- The line of success is never up and to the right. Rather, the story arc is a chaotic, meandering menace. To survive and thrive in the market swings of 2020 requires management and employees dedicated to the mission. Volta’s perseverance and growth in 2020 truly reminded me about the importance of mission and conviction. And Scott, Chris and the Volta team deserve a (brief) respite and congratulations for their efforts.

- At different stages over the past 3+ years every member of the Energize team has helped with Volta. While Tyler and I are involved in board-related governance, I really enjoy how much team-driven support has gone into the investment. Katie has helped with policy intros and messaging… and pounded the table for increased investment in 2020. Juan has been steadily supporting financial analysis since our original 2018 investment. Tyler is a machine on key metrics, and utility introductions for the data product and Kelly is whipping together press and messaging as you read this. Even in his recency, Mark has helped with our most recent Volta investment. The best companies bring everyone involved along for the ride with a feeling of togetherness, and Volta has done that to Energize.

Energize Ventures is amped to announce its participation in Volta Charging’s $125 million Series D. This funding brings Volta’s total equity raised to more than $200 million. Goldman Sachs acted as exclusive placement agent to the company in connection with the financing. Energize managing partner John Tough will continue serving on Volta’s board as lead director, while principal Tyler Lancaster acts as a board observer.

Electricity will fuel the future

If you – like us – believe electric vehicles (EVs) will dominate the future of transportation, then ubiquitous charging infrastructure is required to power the movement of people and goods. We’ll need EV chargers at businesses, in parking lots and alongside highways, near supermarkets, stadiums and other places we all frequent. Volta Charging is meeting that need by building a free public electric fueling network “at the places you like to go.” How? Volta monetizes the network with advertising and real estate site partners, increasing the value of parking lot real estate and attracting EV drivers to the stores, shops, businesses and entertainment centers where they go.

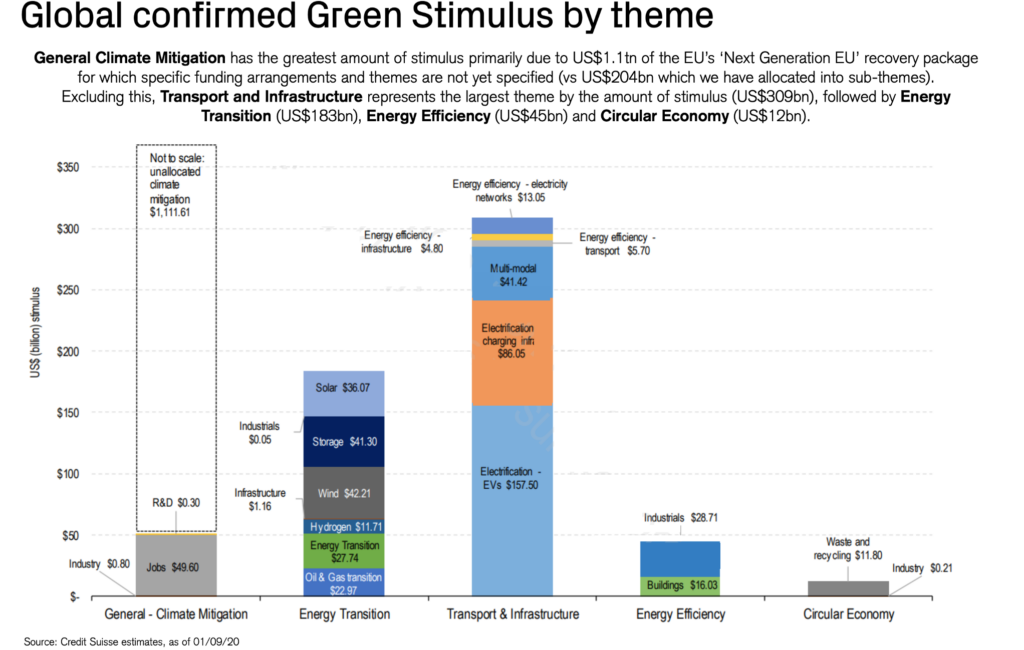

In a wake-up call of sorts, COVID-19 has exposed that we can live with clean air by reducing or outright removing pollution caused by combustion vehicles. As we recharge our economy, it is more important than ever to accelerate the transition to electrified transportation. President Biden plans to push for legislation appropriating $5 billion to support the installation of more than 500,000 EV charging stations by 2030, according to Bloomberg Green. Rapidly electrifying the transportation sector will create thousands of jobs in construction and manufacturing, while cleaning the air in local communities at the places “you like to go.” We believe Volta is poised to lead as the most capital-efficient and highly utilized EV charging network in the U.S.

Capital-efficient EV charging infrastructure

Energize originally led Volta’s Series C in 2018, doubled down to lead the C-2 in 2019, and is tripling down in 2021 with this Series D. After closely tracking the EV charging market for years, we observed firsthand the challenges associated with building a profitable EV charging business by selling electricity or charging hardware alone. Like its gas station predecessors where most revenue comes from sales of coffee and snacks, the EV charging market was begging for a creative approach to monetize with revenue streams beyond selling electrons.

Enter Volta, whose brilliant business model not only can pay off infrastructure costs, but also drives industry-leading utilization – ensuring the EV charging infrastructure we build is actually used. Volta installs EV charging stations with large digital screens in premier parking spots, gives away electricity, and generates revenue from advertising and site hosts. That revenue has the potential to more than covers the costs of charging equipment capital and ongoing maintenance and electricity, which would provide healthy margins as well.

When Energize first met Volta founders Scott Mercer (CEO) and Chris Wendel (President) in 2018, they had deployed a few hundred EV charging stations in Hawaii and California to prove the model. Their team had grand aspirations to expand nationally, and we had plenty of questions on if and how they could replicate their success in other geographies across the U.S. The EV charging landscape was then littered with the corpses of failed pursuits. However, we gained conviction in the team’s single-minded pursuit to build a scalable, profitable EV charging business. We believed their striking product, superior unit economics and long-term contracts with site hosts were strong competitive moats.

Fast forward to today: Volta operates a network of 1,500 EV charging stations around the continental U.S. – including 200 stations here in Energize’s home base of Chicago. The company recently launched a DC fast charging offering to complement its core Level 2 charging product. Additionally, Volta’s internal software can intelligently site EV charging stations, helping utilities evaluate the impact of electric vehicles on electricity demand and plan grid infrastructure upgrades. Volta truly is a full-stack EV charging network.

An EV charging pioneer reaches scale

The Series D capital infusion will enable Volta to expand their network by installing thousands of new EV charging stations – which we believe will create a ripple effect across the market and broader economy. Volta’s infrastructure will be a key platform to publicize the launch of myriad new electric vehicle options planned for release by automotive OEMs over the next five years. It draws EV drivers to retail locations, increasing revenue at a time when many local businesses are struggling. Hundreds of electricians and construction workers will help build and maintain Volta’s EV chargers, employing skilled trade workers on the heels of COVID. Investing large amounts of capital in Volta’s network will create tremendous benefits for communities and the environment, right when we need it most.

Congratulations to Scott, Chris and the entire Volta team on what they’ve built so far! Energize knows that this is just the beginning in the company’s mission to replace fossil fuel molecules with electrons, helping people get where they “like to go” entirely with electricity.