5 Takeaways from Siemens’ $1.6 billion acquisition of Brightly

Yesterday a relatively large deal in the industrial software space was announced:

Siemens acquired US software company Brightly for $1.6 billion. Siemens is the multinational industrial technology company, and has a stated goal to increase their software product suite through its’ Siemens Smart Infrastructure segment.

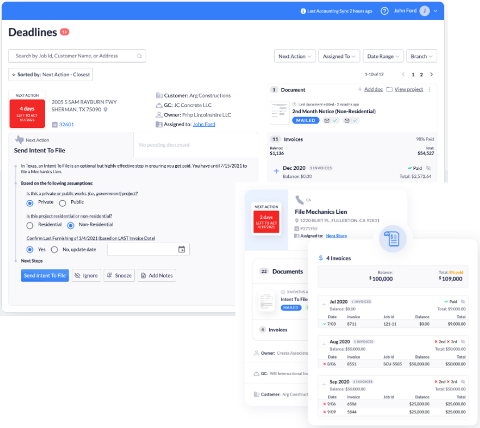

Why is this a fit? Brightly Software is a leader in intelligent asset management solutions and leverages a cloud-based platform with more than 20 years of data to deliver predictive insights through the entire asset lifecycle. Brightly has more than 12,000 clients for their condition monitoring, asset management and IoT Remote Monitoring product suite. The company primarily targets more traditional industries such as education, healthcare and manufacturing.

Brightly is expected to end 2022 with $160M of recurring software as a service (SaaS) revenue, and is growing 13% per year with ~15% operating income. The company will recognize additional non-software revenue as well. Net, Siemens is paying 10x 2022E ARR or about 60x EBIT for a scaled, profitable, and moderately growing asset.

When I see the transaction announcement, a few thoughts jump to mind:

1- Big Balance Sheets Ready to Act: Big industrial firms like Siemens, Rockwell, Emerson, Schneider have huge balance sheets available to them. Each of those firms has recently acquired at least one company. In a more moderate software valuation environment, I expect these large industrials to strategically build their software portfolio.

2- Scaled Assets Required: The large industrials need to buy scaled, P&L-impactful assets. $160M of software ARR is a meaningful addition to a large industrial that will impact the topline of the Smart Infrastructure segment. Sub $100M revenue acquisitions are hard to make an operational dent, and the integration costs and risks of a sub-$100M business are likely the same or greater than a larger business. Industrials are not great at building software businesses and need the acquisitions to operate slightly independently post acquisition. Small companies can be smothered by large industrials – and Brightly likely is big enough to maintain operational agility.

3- Synergies of Trust & Distribution: While there are natural cost synergies, most of the transaction combination synergy will come from added revenue to the Brightly platform. How? Siemens enters the customer relationship through the upfront hardware and systems sale. Now, their army of sales teams will be able to offer Brightly’s product with the initial sale. This increased Siemens distribution and the embedded conglomerate’s trusted brand should push Brightly’s contribution higher.

5- Moderate Growth AND Profit: Siemens has $65 billion of revenue and a $100 billion market cap. Given Siemens slow, single-digit growth rate and depressed 35% gross margin, Siemens enterprise value is a 1.5x sales multiple. With the Brightly acquisition at a10x revenue multiple, Siemens clearly realizes the need to increase exposure to high gross margin software products. Why did the pay that multiple? Complementing core product sales with software is what the public market investor wants. While growth at Brightly was not too high (13%) it is still above Siemens growth rate. The Siemens press release also indicated that the acquisition would be accretive. This is an important “and” – Siemens was able to buy a higher gross margin business with a higher growth rate that also lifted their operating income targets. Those are unique characteristics that drive industrials to pay higher multiples.

Conclusion

In the industrial technology segment, companies need to keep operating goals simple. These buyers don’t need 60% growth rates with creative ways to show future profitability. The P&L owners at the large industrial do not (intentionally) have very much financial creativity and like to see profitability today. In fact, the industrial conglomerates would rather have a scaled business growing 15% per year with a known 15% operating income. Profitability and growth is quite rate in today’s software landscape. At Energize we are pushing many companies to realize that the goal is operational control, not growth at all costs. We have been that way since the beginning and the market is coming back to a more rational approach. Within our portfolio we have a number of excellent companies approaching this profile and believe it will be an active M&A market over the coming 1-2 years.