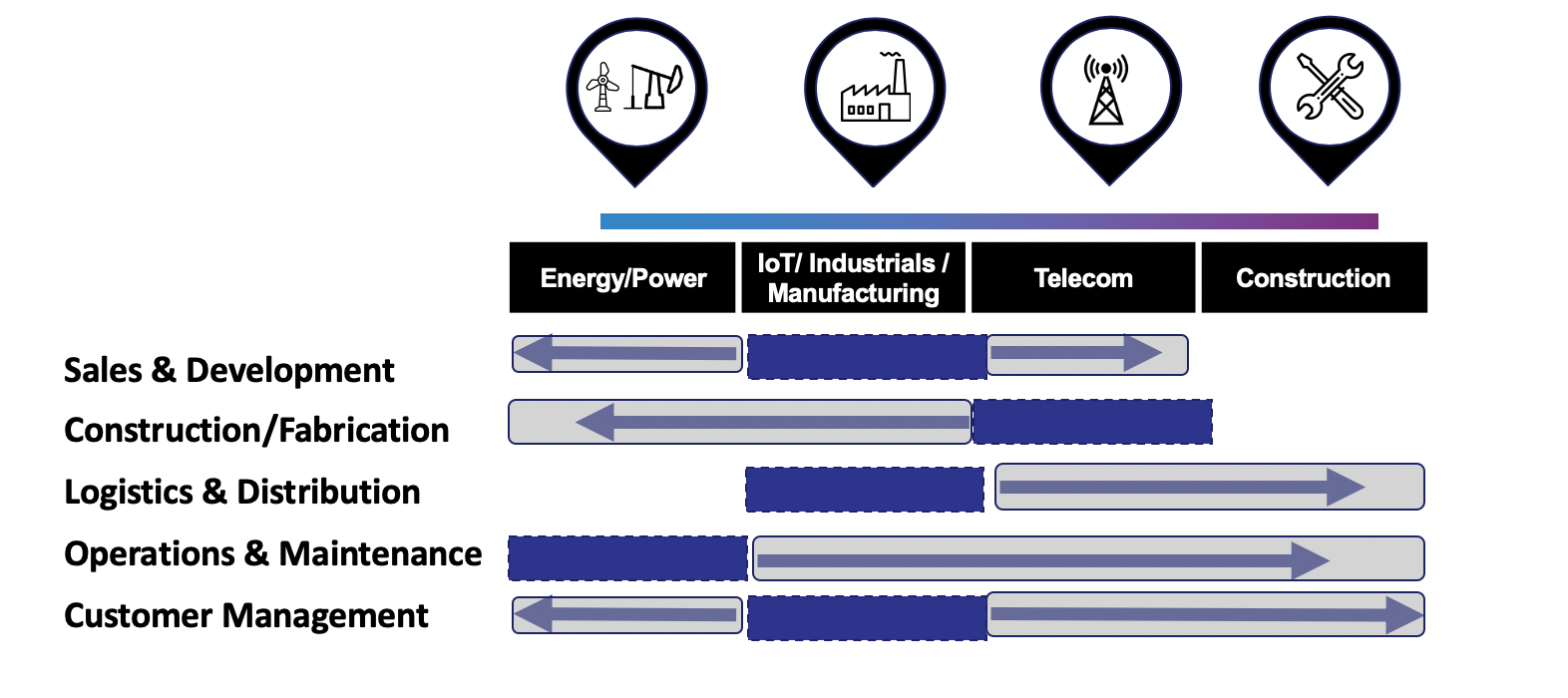

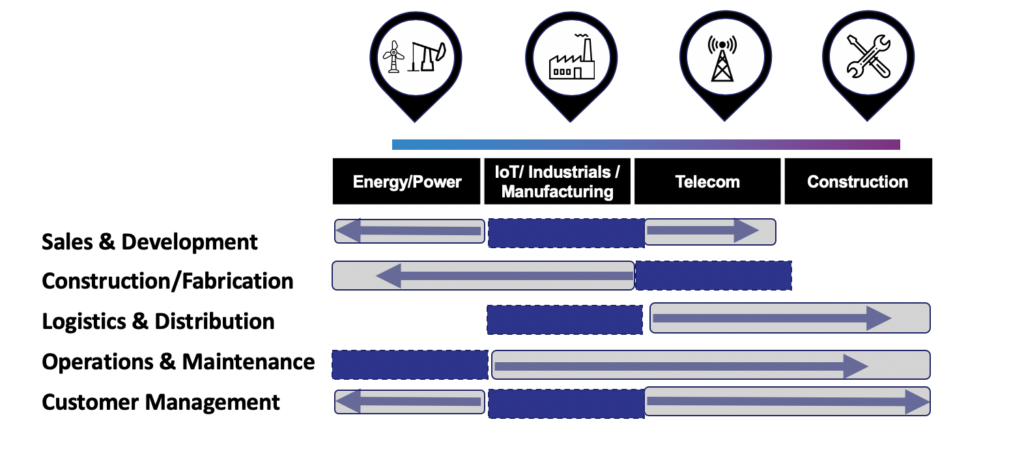

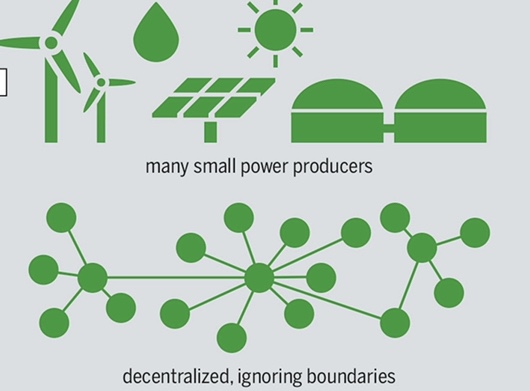

Last week there was another $1 billion + Industrial Technology deal. To most people, it won’t look too much like an “Industrial Tech” exit, but it sure is. To the naked eye, the company will look like tradition telecom equipment. Heck, even the buyer is Ericsson, one of the largest telecom firms in the world. But the fact is that the telecom industry will be one of the most active players in the IoT / industrial technology landscape. Every digital factory or distributed asset is now 5G or wirelessly connected: factories, EV chargers, automobiles, solar arrays, municipal fleets.. industrial assets are connected and the telecom firms are the information highway to our digital industrial world.

The company for today’s exit evaluation is CradlePoint, and they have a combination of routers and endpoint adapters that help corporations harness “LTE and 5G to wirelessly connect fixed and temporary sites, vehicles, field forces, and IoT devices, anywhere.” I first came across CradlePoint when our portfolio company, Volta Charging, was evaluating how to manage 5G connectivity for their chargers. Distributed assets like EV chargers now run a suite of software applications and need access to wireless solutions. Everything is now a computer. And computers need network connection to communicate and update.

As seen on CradlePoint’s site, their hardware/software solutions are used in a number of industrial verticals, including: transportation, digital signage, smart cities/buildings, industrial sites, and retail.

The History

The company was founded in 2006 by Pat Sewall and is headquartered in Boise, Idaho. The first well-documented investment round was the 2010 Series B, where a $11.5M investment at a $51M pre-valuation bought OVP Venture Partners and Highway 12 Partners 18% of the company.

In 2011, George Mulhern became CEO and has held the title ever since.

Over the years the company raised an additional $150M, including an $89M round from TCV in Q4 2016. That investment earned TCV ~25% of the business, meaning that the last notable private market valuation for CradlePoint was a $356M valuation. At the time industry reports show CradlePoint’s revenue around $100M.

The Exit

Last week that Ericsson announced that they are going to pay $1.1 billion for CradlePoint. And in the release the financials were revealed: “Cradlepoint’s revenues: $150 million in 2019 and are expected to grow to $200 million.” This means that Ericsson is paying approximately 6x current revenues for CradlePoint’s business. This is a premium for a primarily HW business. My expectation is that Ericsson sees extra value in being the network provider for the high growth, increasingly digital and distributed asset layer.

All early shareholders and investors are likely to be quite pleased here, including TCV who likely earns >30% IRR and turns $89M into ~$260M within 4 years. The Series B investors likely converted their $11.5M investment into ~$200M at exit.

On timing: CradlePoint took 14 years from launch to exit; and 10 years from their first institutional investment round. Both of these time data points are slightly longer than other exits in the industrial tech vertical. The company has great metrics in terms of cash efficiency and providing sizable returns for the early and growth stage investors.

I have now updated the “Industrial Tech Exits” Google Doc with this deal. Found here