Entrepreneurs at the Industrial Gate

There are nearly 300 companies within the Fortune 1,000 that are broadly characterized by an industrial focus. The medium revenue for these economy-anchoring firms is nearly $4.9 billion, resulting in over $9 trillion in market capitalization. But revenue growth in this space is a far cry from the 20%+ range of the high-tech software companies beginning to dot the economy.

Given the total addressable market and slow-moving perception of these industries, many market-hungry start-ups attempt to attack (or serve) this industry. But, running a technology company to serve the industrial verticals contains many hidden traps. In fact, the slow operating and decision pace employed by industrial or critical infrastructure companies is a feature to their modus operandi, not a bug. Due to the large installed or operating asset base, industrial companies think in decade-long, multi-cycle returns and the capital and customer decision procedures are not meant to reflect one particular market moment.

The entrepreneurs that best address the industrial verticals tend to bring some domain-specific

And while meaningful change can appear frustratingly slow, industrial incumbents that operate primarily in atoms are beginning to feel the attention of bit-bearing software companies.

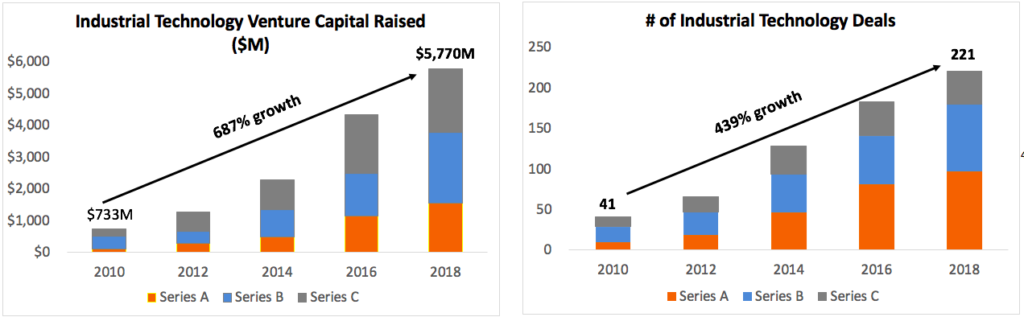

But just how much Series A-C venture capital attention have the construction, power, & energy, logistics & transportation, advanced manufacturing, and resource industries received?

That’s right: last year nearly $6 billion went into Series A, B & C start-ups within the industrial, engineering & construction, power, energy, mining & materials, and mobility segments. Venture capital dollars deployed to these sectors is growing at a 30% annual rate, up from ~$750M in 2010. And while the $6 billion figure is notable due to the growth of VC dollars invested, this early stage investment figure still only equates to ~0.2% of the revenue for the sector and ~1.2% of industry profits.

The number of deals in the space shows a similarly strong growth trajectory. But there are some interesting trends beginning to emerge: the capital deployed to the industrial technology market is growing at a faster clip than the number of deals. These differing growth trajectories mean that the average deal size has grown by 45% in the last 8 years, from $18 to $26 million.

The Detail by Stage

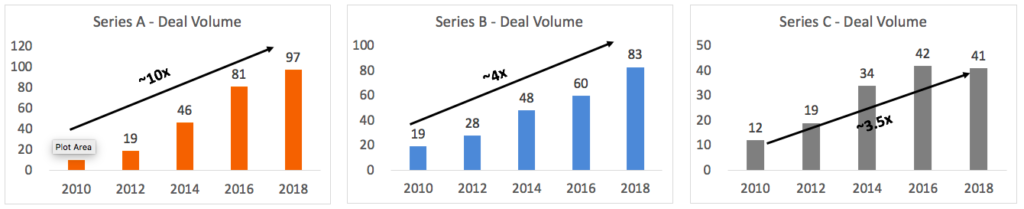

- Median Series A deal size in 2018 was $11M, representing a modest 8% increase in size versus 2012/2013. But Series A deal volume is up nearly 10x since then!

- Median Series B deal size in 2018 was $20M, an 83% growth over the past 5 years and deal volume is up about 4x

- Median Series C deal size in 2018 was $33M, representing an enormous 113% growth over the past 5 years. But, Series C deals have appeared to reach a plateau in the low 40s, so investors are becoming pickier in selecting the winners

These graphs show that the Series A investors have stayed relatively consistent and the overall 46% increase in sector deal size growth primarily originates from the Series B & Series C investment rounds. With bigger rounds, how are valuation levels adjusting?

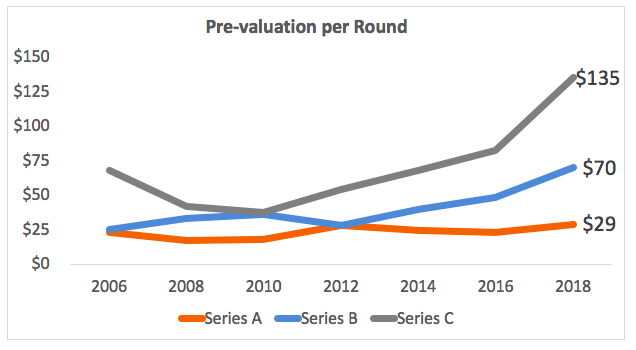

The data shows that valuations have increased even faster than the round sizes have grown themselves. This means that management teams are not feeling any incremental dilution by raising these larger rounds.

- The average Series A round now buys about 24%, slightly less than 5 years ago

- The average Series B round now buys about 22% of the company, down from 26% 5 years ago

- The average Series C round now buys approximately 20%, down from 23% 5 years ago

Some of my conclusions

- Even with the growth in capital deployed, dollars invested as a portion of industry revenue and profit allows for further capital commitments. More entrepreneurs (& VCs supporting them) are likely to come knocking on the industrial gate

- There is a growing appreciation for the industrial sales cycle: investor willingness to wait for reduced risk to deploy even more capital in the perceived winners appears to be driving this trend

- Entrepreneurs that can successfully de-risk their enterprise through revenue, partnerships, and industry hires will gain access to outsized capital pools. The winners in this market tend to compound

- Uncertainty still remains about exit opportunities for technology companies that serve these industries. While there is anecdote (PlanGrid, Kurion, OSIsoft), we are not hearing about a sizable exit from this market on a weekly or monthly cadence. This means that we won’t know for a few years about the returns impact of these rising valuations. Grab your hard hat!

*Data pulled from Pitchbook, scope available by request