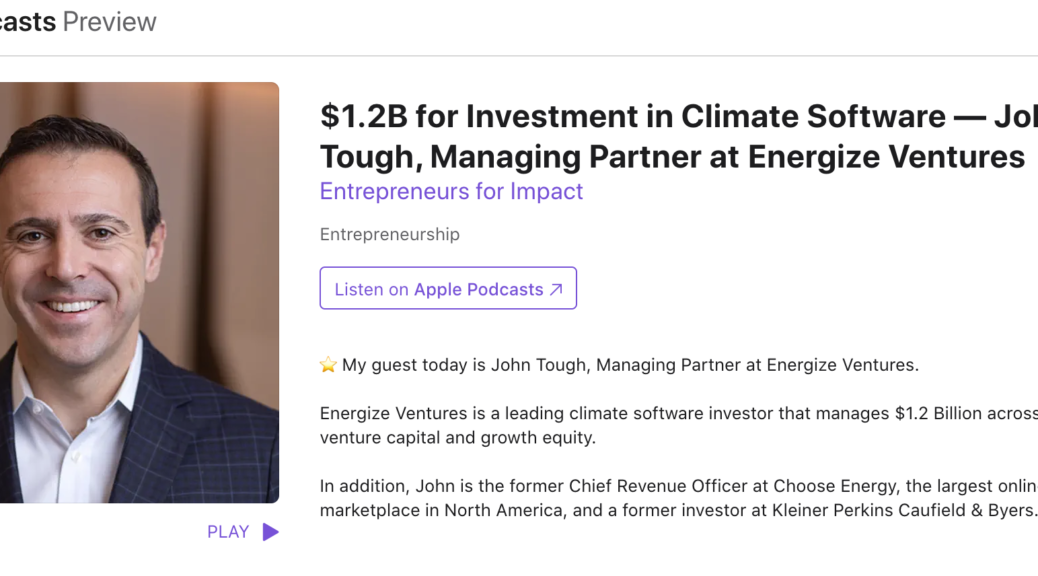

Recorded a Podcast with Chris Wedding

I was on a podcast this week with Chris Wedding and his Entrepreneurs for Impact. Here is his summary below, and the links to the podcast are here: On Spotify and on Apple Podcasts Here is the summary from Chris Want access to $1.2B for investing in climate software? What 4 megatrends are driving climate …